Top 30 Journal Entries Questions And Answers

Do you feel nervous before your interview on journal entries questions and answers? If yes, then this article can provide you with the solution to your problems. As in this article, you will get all the answers of your queries regarding journal entries.

Journal entries is a primary book of accounts where all the financial transactions are kept. Data wise entries of all the transactions you will receive from journal entries. You can easily maintain the double-entry system using journal entries.

So, let’s get into the details of the same regarding the journal entries to have a clear insight to it regarding this matter.

Table of Contents

What Are The Golden Rules Of Accounting?

If you want to maintain the transactions of Journal entry then you need to be well aware of the golden rules of accounts. So, let’s find out the golden rules of accounting first before proceeding to the article.

| Types Of Account | Debit | Credit |

|---|---|---|

| Nominal Account | All Expenses & Losses | All Incomes & Gains |

| Real Account | What comes in | What goes out |

| Personal Account | The Receiver | The Giver |

Become an Industry Ready Accountant TodayGet Job-Ready with Expert Training |

|

| Classroom Course | Online Course |

| More Learning Options for you: Advanced Accounts (Online) | Advanced MS Excel Course (Online) |

|

What Are The Basics Of Journal Entry?

A journal entry is a record of a financial transaction in accounting, used to track business activities in a double-entry bookkeeping system. It ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced. Here are the basics:

1. Purpose Of a Journal Entry

- It helps in recording all financial transactions (e.g., sales, purchases, payments, receipts) in chronological order.

- Provide a clear audit trail for financial reporting and analysis.

- To ensure accurate tracking of debits and credits.

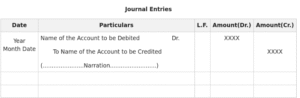

2. Components Of A Journal Entry

Every journal entry includes:

- Date: When the transaction occurred.

- Accounts: The specific accounts affected (e.g., Cash, Accounts Receivable, Sales Revenue).

- Debit and Credit Amounts: Each transaction affects at least two accounts—one debited and one credited, with equal totals.

- Description/Narration: A brief explanation of the transaction.

- Reference Number: A unique identifier for tracking (e.g., invoice or receipt number).

3. Double-Entry System

- Every transaction involves at least one debit and one credit entry.

- Debit: Increases assets or expenses, decreases liabilities or equity.

- Credit: Increases liabilities, equity, or revenue, decreases assets.

- The total debits must always equal total credits.

What Goes Into The Accounting Of Journal Entry?

There are some crucial points that you must consider while maintaining the accounts for journal entry. Some of the key facts that you must know from your end are as follows:-

- Reference number and entry date must be there in journal entry to complete the entry.

- You need to maintain a column to keep track which accounts are affecting.

- The column for your debit side and credit side needs to be maintained properly.

- A footer line known as narration with a brief description you need to maintain stating the reason for the transaction.

Examples Of Journal Entry

Rohim Started A Business With Cash of Rs 700000

| Date | Particulars | LF | Dr Amount (Rs) | Cr Amount(Rs) |

|---|---|---|---|---|

| 1st June 2025 | Cash A/c ————- Dr

To Capital A/c —————- Cr |

700000 | 700000 |

Soham started a business with cash of Rs 100000, furniture of Rs 300000, and building of Rs 2000000.

| Date | Particulars | LF | Dr (Amount) | Cr Amount (Rs) |

|---|---|---|---|---|

| 2nd June 2025 | Cash A/c ———–Dr

Furniture A/c ——Dr Building A/c ——-Dr To Capital A/c ——–Cr |

1,00,000

3,00,000 20,00,000 |

24,00,000 |

Format Of Journal Entry

Few insightful articles on Accounts to improve your knowledge:

List Of Journal Entries Questions & Answers For Interview

There are several types of interview questions you might face while handling an interview on Journal entries questions and answers. So, let’s explore the journal entries one after the other to get a better idea.

1. What Is A Journal Entry?

A journal entry is a record of a financial transaction in the accounting system, used to document the impact of business activities on various accounts. It follows the double-entry bookkeeping method, where each transaction affects at least two accounts—one debited and one credited—with equal amounts to maintain the accounting equation (Assets = Liabilities + Equity). Journal entries include the date, affected accounts, debit and credit amounts, and a brief description, serving as the foundation for the general ledger and financial statements.

2. What Are The Key Components Of Journal Entry?

The key components of a journal entry are:

- Date: The date when the transaction occurred.

- Accounts: The specific accounts affected (e.g., Cash, Revenue).

- Debit and Credit Amounts: The monetary value debited to one account and credited to another, with equal totals.

- Description/Narration: A brief explanation of the transaction.

- Reference Number: A unique identifier (e.g., invoice number) for tracking purposes.

3. How To Decide Which Account To Debit And Which Account To Credit In Journal Entry?

To decide which account to debit and which to credit in a journal entry, follow these steps based on the double-entry accounting system:

- Identify the Transaction: Determine the financial event (e.g., sale, expense, payment).

- Classify Accounts: Categorize the accounts involved (e.g., assets, liabilities, equity, revenue, expenses).

- Apply Debit/Credit Rules:

- Debit: Increases assets or expenses; decreases liabilities, equity, or revenue.

- Credit: Increases liabilities, equity, or revenue; decreases assets or expenses.

- Analyze the Effect: Determine whether the account is increasing or decreasing due to the transaction.

- Ensure Balance: Record the entry so that total debits equal total credits.

- Example: For a Rs 1,000 cash sale, debit Cash (asset increases) and credit Sales Revenue (revenue increases).

4. Can You Explain About The Double Entry Accounting System?

The double-entry accounting system is a fundamental method of bookkeeping where every financial transaction affects at least two accounts, with a debit entry in one account and a corresponding credit entry in another, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. Here’s a breakdown:

- Core Principle: For every transaction, the total debits must equal the total credits. This dual recording helps detect errors and provides a complete financial picture. This is one of the crucial journal entries questions and answers to consider before the interview.

- Account Types and Effects:

- Assets: Increase with a debit, decrease with a credit.

- Liabilities: Increase with a credit, decrease with a debit.

- Equity: Increases with a credit, decreases with a debit.

- Revenue: Increases with a credit, decreases with a debit.

- Expenses: Increase with a debit, decrease with a credit.

- Example: If a business buys $500 of equipment with cash, it debits Equipment (asset increases) and credits Cash (asset decreases) by $500.

- Purpose: Enhances accuracy, supports financial reporting, and is the basis for the general ledger and trial balance.

5. What Is The Difference Between Journal & Ledger Entry?

There are several points of differences between Journal & Ledger entry some of the key points of differences between the two are as follows:-

| Aspects | Journal Entry | Ledger Entry | |

|---|---|---|---|

| Definition | Initial record of a financial transaction in chronological order. | Summary of all transactions for a specific account over a period. | |

| Purpose | To document the transaction with debits and credits as it occurs. | To organize and classify transactions by account for reporting. | |

| Format | Date, accounts, debit/credit amounts, narration. | Account name, date, transaction details, debit/credit totals. | |

| Order | Recorded in chronological order. | Organized by account (e.g., Cash, Sales). | |

| Stage | First step in the accounting cycle. | Second step after posting from the journal. | |

| Detail | Contains detailed narration of each transaction. | Aggregates transactions without narration. | |

| Example | 2025-07-14: Cash Rs1,000 / Sales Rs 1,000 (Narration: Cash sale). |

|

6. How To Handle Errors In Journal Entry?

Handling errors in journal entries requires careful steps to ensure accuracy in financial records. Here’s how to address them:

- Identify the Error: Review the journal entry to spot mistakes (e.g., wrong amount, account, or omission).

- Determine the Type of Error:

- Posting Error: Wrong amount or account posted.

- Omission: Transaction not recorded.

- Reversal Error: Debit and credit swapped.

- Principle Error: Wrong account type used.

- Correct the Error:

- If Unposted: Revise the entry with the correct details before posting.

- If Posted: Create a correcting entry to reverse the error (e.g., debit the credited amount, credit the debited amount) and record the correct entry.

- Use Adjusting Entries: For period-end errors, adjust accounts via an adjusting entry.

- Document the Correction: Include a narration explaining the correction for audit purposes.

- Verify Balance: Ensure debits equal credits after correction.

7. What Is A Compound Journal Entry?

A compound journal entry is a journal entry that involves more than two accounts or multiple debits and credits to record a single financial transaction. It ensures the double-entry principle (total debits = total credits) is there. You need to maintain the books in this manner.

Example:-

On July 14, 2025, a business purchases equipment for Rs 5,000, pays Rs 2,000 in cash, and owes the remaining Rs 3,000. The entry would be:

| Date | Particulars | LF | Dr (Amount) | Cr Amount (Rs) |

|---|---|---|---|---|

| 14 th July 2025 | Equipment A/c ———–Dr

Cash A/c ————–Cr Accounts Payable A/c ————–Cr (Purchased Equipment with Partial Cash & Credit) |

Rs 5000 | Rs 3000

Rs 2000 |

8. Describe A Situation Where You Created A Complex Journal Entry In A Previous Role?

This question is quite tricky and the candidate must answer this question depending on their personal experiences where being a candidate you have encountered such a scenario. So, you must answer this psychometric question depending on your personal experience.

9. What Is A Contra Account And How It Is Used In Journal Entry?

A contra account is an account to offset the balance of a related account, typically reducing its net amount on the financial statements. It has an opposite normal balance to its paired account.

Key Points:

- Purpose: Tracks reductions, allowances, or accumulated depreciation for assets, liabilities, or equity.

- Examples:

- Accumulated Depreciation (contra to an asset like Equipment).

- Allowance for Doubtful Accounts (contra to Accounts Receivable).

- Sales Returns (contra to Sales Revenue).

- Normal Balance: Opposite to the main account (e.g., credit balance for asset contra accounts, debit balance for liability contra accounts).

10. What Are The Journal Entries For Depreciation?

Journal entries for depreciation record the allocation of an asset’s cost over its useful life, reducing its book value and recognizing an expense. The most common method is straight-line depreciation. Here are the typical entries:

Example:-

When depreciation is calculated for a period (e.g., Rs 1,000 annually for equipment):

Depreciation Expense A/c —————————- Dr 1000

To Accumulated Depreciation A/c ———————————–Cr 1000

11. What Are The Journal Entries For Bad Debt?

The journal entry for bad debt depends on the accounting method used. The most common approach is the allowance method, which estimates bad debts in advance. Here’s the typical entry. It is one of the crucial journal entries questions and answers to know before crafting the transactions.

1. Estimating Bad Debt Expense (Allowance Method)

When estimating bad debts for a period (e.g.,Rs 500 based on sales or aging analysis) on July 14, 2025,

14-7-2025 Bad Debt Expense A/c ——————–Dr Rs 500

Allowance for Doubtful Debt A/c ——————-Cr Rs 500

(Narration: Recorded estimated bad debt expense for the period)

- Bad Debt Expense: Increases (debit) as an expense on the income statement.

- Allowance for Doubtful Accounts: Increases (credit) as a contra-asset account to reduce Accounts Receivable on the balance sheet.

- Writing Off a Specific Bad Debt

When a specific receivable (e.g., Rs 200) is there for uncollectible.

14-7-2025 Allowance For Doubtful Accounts Dr ———————-Rs 200

To Accounts Receivable Cr ———————————- Rs 200

Narration ( Written Off uncollectable Receivables)

12. What Are The Journal Entries For Prepaid Expenses?

Journal entries for prepaid expenses record payments made in advance for goods or services to be received in the future. These are initially recorded as assets and later expensed over time. Here are the typical entries:

1. Recording the Prepaid Expense

When a payment is made in advance (e.g., Rs 1,200 for 12 months of rent on July 14, 2025):

14-7-2025 Prepaid RentA/c ——————- Dr Rs 1,200

CashA/c ————————————– Cr Rs 1,200

(Narration: Paid 12 months of rent in advance)

13. What Is The Journal Entry For Accounts Receivable?

Journal entries for prepaid expenses record payments made in advance for goods or services to be received in the future. These are initially recorded as assets and later expensed over time. Here are the typical entries:

1. Recording The Prepaid Expense

When a payment is made in advance (e.g., Rs 1,200 for 12 months of rent on 14-7- 2025):

Prepaid Rent: Increases (debit) as an asset on the balance sheet.

Cash: Decreases (credit) as the payment is made.

- Amortizing the Prepaid Expense

When the expense is recognized each period (e.g., Rs100 monthly):

2025-08-14 Rent Expense A/c ————————Dr Rs 100

Prepaid RentA/c ————————————–Cr Rs 100

(Narration: Recognized one month of prepaid rent expense)

14. What Are The Journal Entries For Accounts Payable?

Journal entries for accounts payable record liabilities for goods or services purchased on credit, their payment, and any adjustments. Here are the typical entries:

1. Recording a Purchase on Credit

When goods or services are purchased on credit (e.g., Rs 1,000 worth of inventory on July 14, 2025)

14-7-2025 InventoryA/c —————————–Dr Rs 1,000

Accounts PayableA/c ———————————-Cr Rs 1,000

(Narration: Purchased inventory on credit)

- Inventory: Increases (debit) as an asset.

- Accounts Payable: Increases (credit) as a liability.

- Payment Of Accounts Payable

When the liability is settled (e.g., paying Rs 1,000 in cash):

14-7-2025 Accounts Payable A/c—————————–Dr Rs 1000

To Cash A/c ——————————————Cr Rs 1000

(Narration: Paid amount owed to supplier)

- Accounts Payable: Decreases (debit) as the liability is reduced.

- Cash: Decreases (credit) as payment is made.

3. Adjusting Entry for Discounts (if applicable)

If a discount is taken for early payment (e.g., 2% discount on Rs 1,000 = Rs 20):

Accounts Payable A/c ———————–Dr Rs 1,000

Cash A/c ———————–Cr Rs 980

Purchase Discounts A/c ———-Cr Rs 20

(Narration: Paid accounts payable with 2% early payment discount)

15. What Is The Journal Entry For Sales?

Journal entries for sales record the revenue generated from selling goods or services, depending on whether the sale is for cash or on credit.

1. Cash Sale

When goods or services are sold for cash (e.g., Rs 500 on July 14, 2025):

2025-07-14 Cash A/c ——————-Dr Rs 500

Sales Revenue A/c ——————-Cr Rs 500

(Narration: Recorded cash sale of goods)

- Cash: Increases (debit) as an asset.

- Sales Revenue: Increases (credit) as income on the income statement.

16. What Are The Journal Entries For Expenses?

Journal entries for expenses record the costs incurred by a business in its operations, typically affecting an expense account and a corresponding asset or liability account.

Example:-

When Expense Paid Immediately

Utility Expense A/c ——————————- Dr 300

To Cash A/c ——————————————————-Cr 300

( Narration: Paid utility bill for the month)

- Utilities Expense: Increases (debit) as an expense on the income statement.

- Cash: Decreases (credit) as an asset.

17. What Is The Journal Entry For Fixed Assets Purchased On Credit?

The journal entry for a fixed asset purchased on credit records the acquisition of a long-term asset with a promise to pay later.

Journal Entry

When a fixed asset (e.g., equipment costing Rs 5,000) is purchased on credit on July 14, 2025:

14-7-2025 Equipment A/c ———————–Dr Rs 5,000

Accounts Payable A/c————————- Cr Rs 5,000

(Narration: Purchased equipment on credit)

- Equipment: Increases (debit) as a fixed asset on the balance sheet.

- Accounts Payable: Increases (credit) as a liability representing the amount owed.

18. What Is The Journal Entry For Bills Of Exchange?

The journal entry for a bill of exchange depends on the role of the business (drawer, drawee, or payee) and the stage of the transaction (acceptance, endorsement, or payment). A bill of exchange is a written order to pay a specified amount on a future date. It is one of the crucial journal entries questions and answers for the interview.

- Drawer Records Sale and Issues Bill

When a seller (drawer) sells goods worth $1,000 and receives a bill of exchange from the buyer on July 14, 2025:

14-7-2025 Accounts Receivable A/c ———————–Dr Rs 1,000

Sales RevenueA/c ——————————Cr Rs 1000

(Narration: Sold goods and received bill of exchange)

- Later, if the bill is discounted with a bank (e.g., $50 discount), the entry adjusts:

14-7-2025 Cash A/c ———————————————————–Dr Rs950

Discount on Bills Receivable A/c ——————————– Dr Rs 50

Accounts Receivable A/c —————— —————————————-Cr Rs 1000

(Narration: Discounted bill of exchange with bank)

2. Drawee Accepts the Bill

When the buyer (drawee) accepts the bill, no immediate entry is made by the drawee until maturity or payment. Upon acceptance, the drawee acknowledges the liability, but the entry is recorded when the obligation is incurred or paid.

3. Payment of Bill by Drawee

When the drawee pays the bill (e.g., Rs 1,000) at maturity on the due date:

14-7-2025 Accounts Payable A/c —————-Dr 1,000

Cash A/c —————————-Cr 1,000

(Narration: Paid bill of exchange at maturity)

19. What Is The Journal Entry For Petty Cash?

The journal entry for petty cash involves setting up a petty cash fund, replenishing it, and recording expenses.

Establishing the Petty Cash Fund

When a petty cash fund is created (e.g., Rs 500 in cash is set aside on July 14, 2025):

2025-07-14 Petty Cash A/c ——————-Dr Rs 500

CashA/c —————————-Cr Rs 500

(Narration: Established petty cash fund)

- Petty Cash: Increases (debit) as an asset.

- Cash: Decreases (credit) as cash is withdrawn from the main account.

20. What Is The Journal Entry For Dividend Declaration?

The journal entry for dividend declaration records the decision to distribute profits to shareholders, creating a liability until the dividend is paid. It is one of the crucial Journal Entries questions and answers to look forward to it.

1. Declaring a Cash Dividend

When a company declares a dividend (e.g., Rs 1,000 to be paid to shareholders on July 14, 2025):

14-7-2025 Dividends Payable A/c —————–Dr Rs 1,000

Retained Earnings A/c ———————————Cr Rs 1,000

(Narration: Declared cash dividend to shareholders)

- Dividends Payable: Increases (credit) as a liability on the balance sheet.

- Retained Earnings: Decreases (debit) as a reduction in equity, reflecting the distribution of profits.

21. Which Transaction Should Be Recorded First Journal Or Ledger?

The journal should be recorded first, followed by the ledger.

- Reason: The journal is the initial step in the accounting cycle where transactions are recorded in chronological order with their debits and credits, serving as the “book of original entry.” After journaling, these entries are posted to the ledger, which organizes transactions by account for reporting purposes. This sequence ensures an accurate and systematic flow of financial data.

22. What Is The Impact Of Journal Entry On Profit & Loss A/c?

The impact of a journal entry on the Profit & Loss Account (P&L A/c) depends on the accounts involved, as it reflects the financial performance (revenue, expenses, and net profit) over a period. Journal entries questions and answers revolve around this fact as well.

- Direct Impact: Journal entries affecting revenue or expense accounts directly influence the P&L A/c.

- Indirect Impact: Entries involving assets, liabilities, or equity (e.g., prepaid expenses, depreciation) affect P & LA/c when expensed or recognized over time.

23. Why Are Accounting Vouchers Prepared?

Accounting vouchers are prepared to:

- Document Transactions: Provide written evidence of financial transactions (e.g., invoices, receipts).

- Ensure Accuracy: Verify the correctness of amounts, accounts, and authorizations involved.

- Support Journal Entries: Serve as the basis for recording entries in the journal, linking them to source documents.

- Facilitate Auditing: Offer a clear audit trail for verification and compliance with accounting standards.

- Track Accountability: Record approvals and responsibilities for internal control purposes. Select the best journal entries questions and answers to meet your needs with ease.

24. Give Essentials Of Accounting Vouchers?

- Date of Transaction Indicates when the financial activity occurred.

- Voucher Number A unique serial number for tracking and referencing.

- Type of Voucher Specifies whether it’s a payment, receipt, journal, or non-cash voucher.

- Accounts Involved Clearly mentions which accounts are debited and credited.

- Amount The exact figures involved in the transaction, both in numbers and words.

- Narration A brief description explaining the nature and purpose of the transaction.

- Supporting Documents Includes invoices, bills, receipts, or contracts attached to validate the transaction.

- Authorized Signatures Signatures from responsible personnel to approve and authenticate the voucher.

- Compliance Details Any applicable tax information, discount terms, or regulatory notes.

25. Discuss The Complete Process Of Posting Journal To Ledger Account?

1. Understand the Journal Entry

- Each journal entry records a transaction with:

- Date

- Accounts affected

- Debit and credit amounts

- Narration

2. Identify the Ledger Accounts Involved

- For every journal entry, determine:

- Which account is debited

- Which account is credited

3. Open the Ledger Accounts

- Ensure each account has its own page or section in the ledger.

- If not already created, open new accounts in the ledger.

4. Post the Debit Side

- Go to the ledger account that was debited in the journal.

- Record:

- Date of transaction

- “To [Credit Account Name]” in the particulars column

- Journal Folio (J.F.) number

- Amount in the debit column

5. Post the Credit Side

- Go to the ledger account that was credited in the journal.

- Record:

- Date of transaction

- “By [Debit Account Name]” in the particulars column

- Journal Folio (J.F.) number

- Amount in the credit column

6. Cross-Reference Entries

- In the journal, note the ledger page number (L.F.) for each account.

- In the ledger, note the journal page number (J.F.) for traceability.

7. Update Balances

- After posting, update the running balance in each ledger account.

- This helps in preparing the trial balance later.

8. Perform Ledger Balancing (Periodically)

- At the end of a period:

- Total the debit and credit sides

- Determine the balance (debit or credit)

- Carry forward the balance to the next period

26. What Are The Different Types Of Accounts?

In accounting, accounts are categorized based on how they track financial transactions. Here are the main types of accounts:

- Assets: Resources owned by a business with economic value (e.g., cash, inventory, equipment, real estate).

- Liabilities: Obligations or debts a business owes (e.g., loans, accounts payable, mortgages).

- Equity: The owner’s or shareholders’ residual interest in the business after liabilities are deducted (e.g., capital, retained earnings).

- Revenue: Income earned from business activities, like sales or services.

- Expenses: Costs incurred to generate revenue (e.g., rent, utilities, salaries).

27. What Are The Common Errors Of Journal Entry?

In accounting, journal entries record financial transactions, but errors can occur during the process. Below are the most common types of journal entry errors, explained concisely:

- Errors of Omission: Failing to record a transaction entirely (e.g., a sale or expense is not entered).

- Commission Errors: Recording a transaction in the wrong account (e.g., debiting “Rent Expense” instead of “Utilities Expense”).

- Errors of Principle: Violating accounting principles (e.g., recording a capital expenditure as an expense instead of an asset).

- Original Entry Errors: Entering the wrong amount (e.g., recording Rs500 as Rs 5,000).

- Errors of Reversal: Reversing the debit and credit entries (e.g., debiting a liability account and crediting cash for a payment received).

- Compensating Errors: Multiple errors that cancel each other out, masking discrepancies (e.g., overstatement in one account offsets an understatement in another).

- Duplication Errors: Recording the same transaction more than once.

- Errors of Posting: Incorrectly transferring journal entries to the ledger (e.g., posting to the wrong ledger account or omitting a posting).

28. What Are The Importance Of Journal Entry?

Journal entries are the foundation of accurate financial accounting, and their importance spans across compliance, decision-making, and transparency. Here’s a breakdown of why they matter:

- Accurate Financial Reporting Journal entries ensure every transaction is recorded with precision, forming the basis for financial statements like the balance sheet, income statement, and cash flow statement.

- Chronological Recordkeeping Entries are logged in the order they occur, making it easy to trace and audit financial activities over time.

- Transparency & Auditability Each entry includes narration and supporting documentation, which helps auditors and stakeholders understand the nature of transactions.

- Decision-Making Support Reliable journal data helps management analyze performance, forecast trends, and make informed strategic decisions.

- Legal & Tax Compliance Proper journal entries help businesses comply with tax laws and accounting standards, reducing the risk of penalties.

- Error Detection & Correction Mistakes in ledgers or trial balances can be traced and corrected using journal entries, maintaining the integrity of financial records.

- Basis for Ledger Posting Journal entries are the first step in the accounting cycle and feed directly into ledger accounts, which are used to prepare trial balances and financial statements

29. How Journal Entry Affects The Final Account?

A journal entry is the first step in the accounting cycle. It records every business transaction in the books of the original entry (the journal). Here’s how this affects the final accounts:

1. Recording Transactions

- Each transaction is first analyzed and then recorded in the journal using debit and credit rules.

- Example: If you buy furniture for cash, you debit Furniture A/c and credit Cash A/c.

2. Posting to Ledger

- These journal entries are then posted to the ledger accounts.

- The ledger groups all transactions account-wise (e.g., all cash transactions, all sales transactions).

3 Trial Balance

- From the ledger balances, a trial balance is prepared to check the arithmetic accuracy of debits and credits.

- Preparation of Final Accounts

- The trial balance figures are used to prepare the Final Accounts, which include:

- Trading Account → to find Gross Profit or Loss

- Profit & Loss Account → to find Net Profit or Loss

- Balance Sheet → to show the financial position

Impact

If the journal entries are correct, the final accounts will reflect the true profit or loss and the true financial position.

30. What Is The Impact Of Journal Entry On Trading Account?

Journal entries have a direct and foundational impact on the Trading Account, which is used to calculate a business’s gross profit or loss from its core operations. Here’s how journal entries shape the Trading Account:

- Transfer of Direct Expenses and Revenues

- Journal entries record direct expenses like purchases, wages, carriage inward, and opening stock.

- These are transferred to the debit side of the Trading Account.

- Direct revenues like sales and closing stock are transferred to the credit side.

- Closing Entries

- At the end of the accounting period, journal entries are passed to close nominal accounts related to trading.

- These include:

- Trading A/c Dr. To Opening Stock A/c To Purchases A/c To Wages A/c (and other direct expenses)

- Sales A/c Dr. Closing Stock A/c Dr. To Trading A/c

- Gross Profit or Loss Calculation

- If the credit side of the Trading Account surpasses the debit side, the difference is Gross Profit:

- Trading A/c Dr. To Profit & Loss A/c

- If the debit side exceeds the credit side, the difference is Gross Loss:

- Profit & Loss A/c Dr. To Trading A/c

Final Takeaway

Hence, these are some of the crucial factors of Journal entries questions and answers that you must be well aware of. You must get through the details of this article to have a clear insight to it.

You can share your views and opinions in our comment box. This will help us to know your take on this matter. So, let’s explore the facts to know things that work for you in a perfect manner.

- Why GST Is Called an Indirect Tax - September 20, 2025

- Chart Of Accounts In Tally Prime: A Complete Overview - September 15, 2025

- Ways To Handle Purchase Entry In Tally Prime - September 10, 2025