Why GST Is Called an Indirect Tax

Have you ever bought something and wondered who really pays the tax? That question helps us understand why GST is called an indirect tax. Simply put, GST (Goods and Services Tax) is levied on goods and services, but the burden of the tax is passed on from businesses to the final consumer. That shifting of the burden is the heart of “indirect tax.”

In this blog, we’ll dive into what makes GST indirect. We’ll compare direct vs. indirect taxes. We’ll use easy examples and tables to make it clear. By the end, you’ll see not just what GST is, but why it’s called an indirect tax, and why it matters for both consumers and businesses.

Table of Contents

What Is GST?

GST stands for Goods and Services Tax. It is a tax on the supply of goods and services.

- It is multi-stage: tax is collected at every point in the supply chain — like when raw materials are bought, made into products, transported, sold to wholesalers/retailers, and finally bought by consumers.

- It is destination-based: tax revenue goes to the state where the goods or services are consumed, not just where they are produced.

What Does “Indirect Tax” Mean?

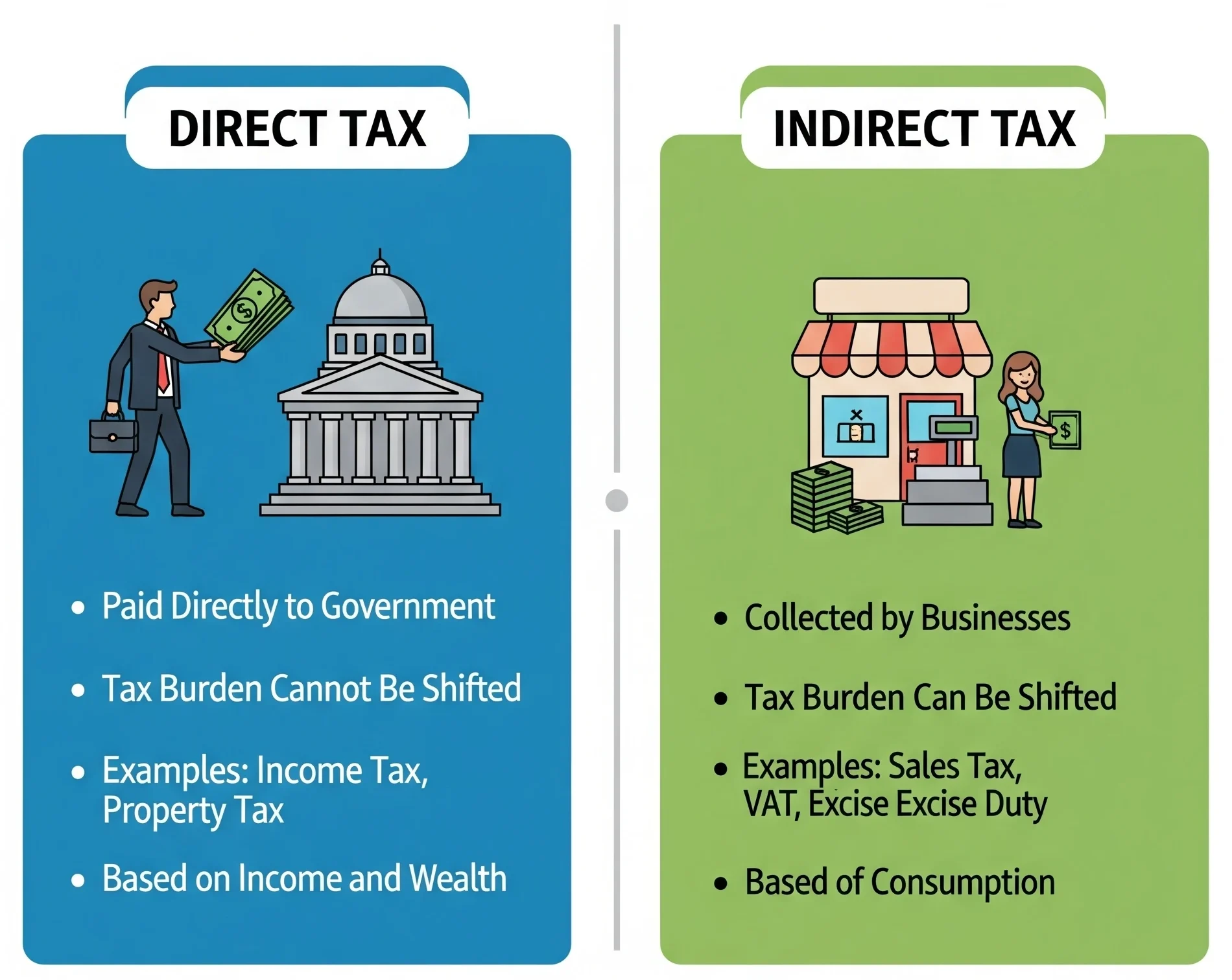

To understand why GST is called an indirect tax, we need to define “indirect tax” and compare it with “direct tax.”

Definition of Indirect Tax

An indirect tax is a tax where the person who initially pays the tax (say, a business) can pass on the cost to someone else (normally the final consumer). The key idea: the burden shifts. GST is like this.

Direct Tax vs Indirect Tax: A Side-by-Side Comparison

| Feature | Direct Tax | Indirect Tax |

|---|---|---|

| Who bears the burden permanently | The person on whom it is levied (e.g. income tax on you) | Can be shifted downstream |

| Who pays the tax to government | The taxpayer themselves | Businesses collect from customers and remit to government |

| Examples | Income tax, corporate tax, property tax | GST, VAT (in older systems), excise duty, service tax (before GST) |

| Predictability for consumer | High (they see the cost directly, tax deducted in salary etc.) | Often less visible (tax is in price) |

Why GST Is an Indirect Tax

Now, let’s clearly see why GST is called an indirect tax by matching its features with the traits of an indirect tax.

Passing on the Tax Burden

- A manufacturer purchases raw material, pays GST for input. When the manufacturer sells, they include GST in the price. The buyer (next stage) pays that. Eventually, the final consumer pays for all GST stages combined.

- Businesses collect GST at each stage but don’t bear the final cost. The final cost is included in the price paid by end-users.

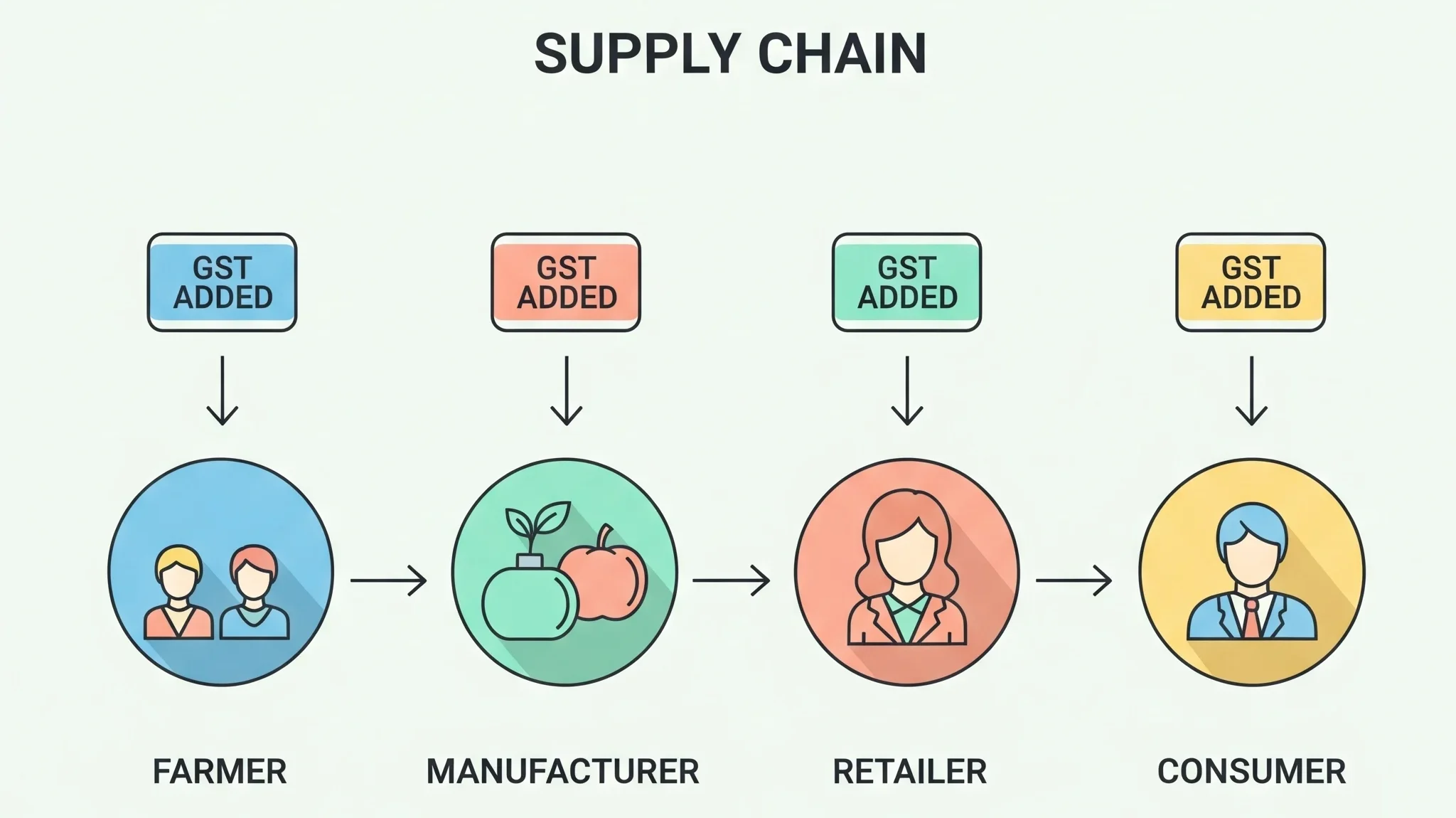

Multi-Stage and Value Addition

- At each stage in the supply chain, value is added (raw material → manufacture → transport → retail).

- GST is levied at each value-addition stage, but credit is given for tax paid at earlier stages (input tax credit). This avoids the tax-on-tax (cascading) effect.

GST vs Old System of Indirect Taxes

Before GST, India had multiple indirect taxes: VAT, central excise duty, service tax, luxury tax, etc.

| Old Indirect Taxes | Problems | How GST Solved It |

|---|---|---|

| Separate VAT at state level; service tax at central level; excise duties | Overlaps, complex compliance, cascading taxes | Unified under one regime; cleaner input tax credit; fewer overlapping layers |

| Different laws and rates in different states | Confusion; tax arbitrage; additional cost of interstate trade | Standardisation; IGST for inter-state; common rules via GST Council |

| Multiple returns, many authorities | Time-consuming; cost of compliance high | Single registration, unified return process; online portals; less paperwork |

Other Features of GST (That Reinforce It as Indirect Tax)

These features further show why GST belongs in the indirect tax category.

Input Tax Credit

- Businesses get credit for the GST already paid on their inputs (raw materials, services used).

- This ensures that only net value addition is taxed at each stage.

- Helps avoid cascading tax (one tax on another).

Final Consumer Pays the Tax

- Although businesses collect the tax, consumers ultimately pay it.

- Because tax is bundled in the product or service price.

- So the government gets the tax from businesses, but the money comes from consumers. That is the essence of indirect taxation.

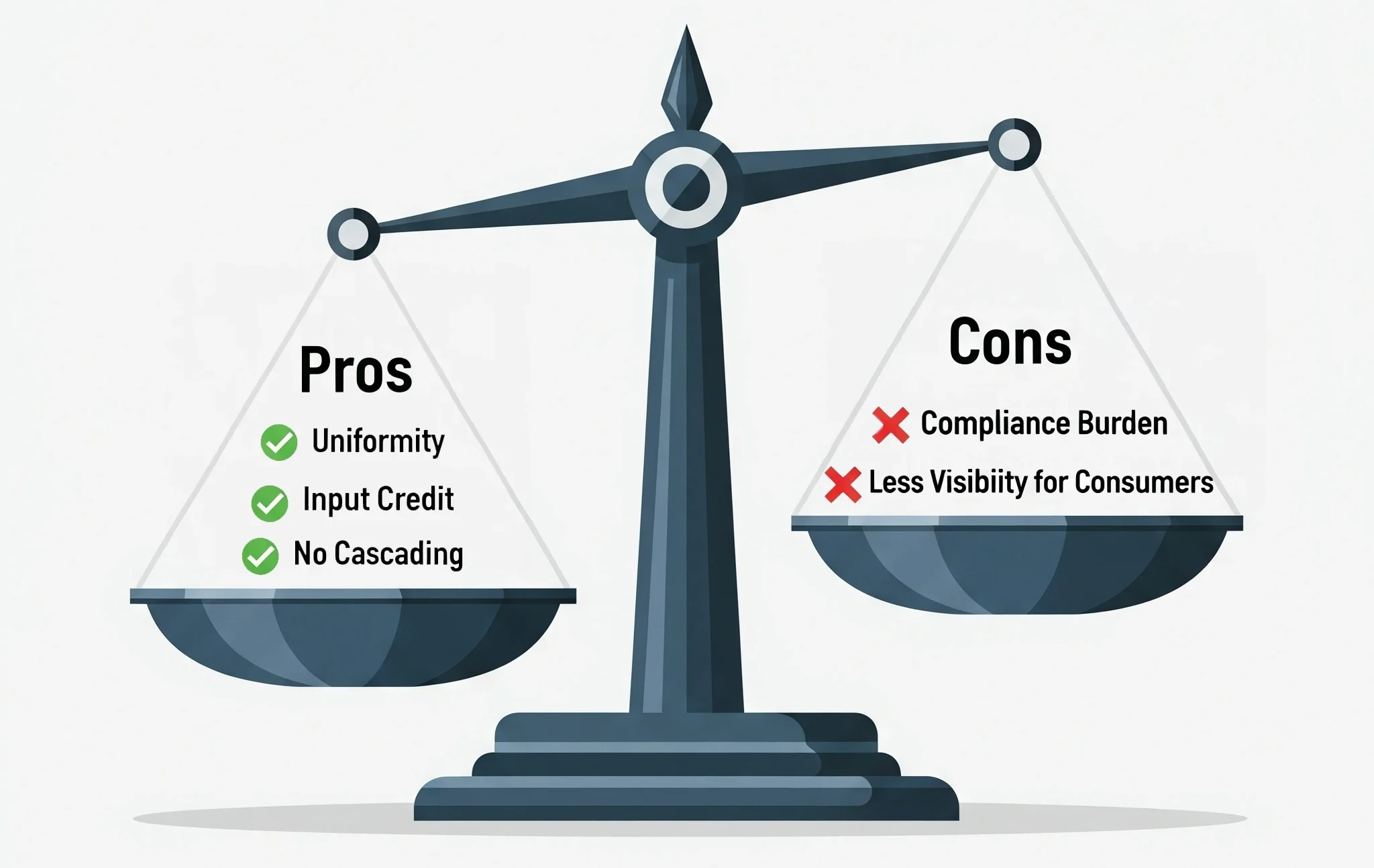

Pros and Cons of GST as Indirect Tax

Let’s look at advantages and disadvantages. This helps you see why calling GST “indirect tax” matters in practice.

| Pros | Cons |

|---|---|

| Easier tracking and unified tax base | Some goods/services become costlier if tax slabs change |

| Removal of cascading taxation; fair pricing | Compliance burdens on small businesses (return filing, record keeping) |

| Uniformity across states; reduces trade barriers | Consumers may not see tax clearly; price includes tax so less transparency sometimes |

| Better input tax credit helps businesses | Mistakes in tax credit or rates can lead to disputes |

Examples to Clarify

Here are simple examples to show why GST is called an indirect tax in real life.

Example 1 – Manufacturing Chain

- The farmer sells wheat to miller. Miller pays GST on the wheat.

- Miller processes flour and sells it to the bakery. The bakery pays GST, but miller passes on cost via price.

- The bakery sells bread to consumers. The consumer pays tax included in the price.

Net result: every stage collected GST except the last stage also got input credit. The final consumer bears the cost. That is indirect.

Example 2 – Service Providers

- A digital marketing agency hires freelancers. Agency pays GST on services procured.

- When an agency provides service to clients, it includes its own cost + freelancers’ cost + GST.

- Client pays GST-included amount. Client (as end-user) bears the final burden (unless the client is a business and can claim input credit).

Why the Term “Indirect Tax” Is Important?

You might think it’s just semantics. But knowing why GST is called an indirect tax matters because:

- It helps in understanding who ultimately pays the tax.

- It shows how the tax burden shifts across the supply chain.

- It aids in policy debates (e.g. “who benefits”, “who bears more burden”).

- It clarifies tax law and rights (like claiming input tax credits, transparency).

Conclusion

So, in summary, GST is called an indirect tax because:

- The tax burden is shifted from businesses to final consumers.

- It is multi-stage and value-addition based.

- Only the end user really pays, while each earlier stage gets credits.

Understanding this helps everyone—from consumers to business owners—see how GST affects prices, profit margins, and transparency.

Read some more GST articles here:

Frequently Asked Questions

- Why is GST called an indirect tax rather than a direct tax?

Because in GST, the tax is collected at each stage of supply but the final burden is borne by the consumer, not the business. The business just acts as a collector. This is the essence of an indirect tax. - How does GST differ from direct tax and why does that matter?

Direct taxes are directly levied on your income or property, with no shifting of burden. GST, being indirect, shifts cost along the supply chain. This matters because it influences who ends up paying and how tax policy affects prices. - What role does input tax credit play in proving GST is an indirect tax?

Input tax credit allows businesses to reduce their tax liability by the GST already paid on inputs. This ensures only value added at each stage gets taxed, preventing cascading. That mechanism is key to why GST functions as an indirect tax. - Are there cases where GST is not seen as indirect tax?

Not really—by design, GST is always an indirect tax. However, businesses who are final consumers (i.e. they do not sell further) will bear the burden, so for them, it may feel like a direct tax. But legally and economically, it remains an indirect tax. - How does the consumer benefit from GST being indirect tax?

They benefit because tax-on-tax (cascading) is reduced. Prices may be lower due to input tax credits. Also, there’s greater transparency. Indirect tax structured well can lead to fairer pricing across goods and services. - Will GST rates or slabs affect whether it feels indirect?

Yes. If slab changes are abrupt, or input tax credit rules are tight, businesses may absorb some burden (temporarily), making the effect less visible to consumers. But in all scenarios, since the legal burden shifts downstream, it remains an indirect tax.

If you want to better manage your taxes—whether you run a business or just buy stuff regularly—learn how GST works in your context. Stay aware of your rights like input tax credit. Also, share this blog with someone who’s confused about taxes—help them see why GST is called an indirect tax, too!

- 3 Smart Ways to Speed Up Data Entry and Processing in Excel - January 27, 2026

- How to Convert Images Containing Tables into Editable Excel - January 27, 2026

- One Nation, One ID: Understanding the Academic Bank of Credits - January 22, 2026