Depreciation Entry In Accounting: Definition, Methods Of Calculation & Examples

Depreciation entry in accounting is a systematic allocation of the cost of a tangible fixed asset over its useful life, reflecting the asset’s gradual loss in value due to wear and tear, obsolescence, or usage.

In accounting, depreciation entry records this non-cash expense in the books, ensuring that the cost of the asset is matched with the revenue it helps generate (matching principle) and complies with accrual-based accounting standards like IFRS and GAAP.

The most common depreciation entry under the straight-line method involves debiting Depreciation Expense (an income statement account) and crediting Accumulated Depreciation (a contra-asset account on the balance sheet).

Table of Contents

- What Is Depreciation In Accounting?

- What Is Journal Entry For Depreciation?

- Example Of Depreciation

- Different Methods For Calculation Of Depreciation

- Which Methods Should You Employ?

- Most Common Real-World Choices

- What Is Accumulated Depreciation?

- Formula Of Accumulated Depreciation

- Importance For The Calculation For Depreciation

- Format For Calculation Of Depreciation

- Impact Of Depreciation On Financial Statement

- Frequently Asked Questions

- Final Takeaway

What Is Depreciation In Accounting?

Depreciation is the accounting process of gradually writing off the cost of a tangible fixed asset (like machinery, vehicles, buildings, furniture, computers, etc.) over its useful life.

Instead of charging the entire cost as an expense in the year you buy the asset, depreciation spreads that cost across the years the business actually uses the asset. This follows the matching principle: expenses should be recorded in the same period as the revenues they help generate.

Key Points

- This is a non-cash expense – no money leaves the bank when you record depreciation.

- It reduces taxable income (and therefore tax payable in most countries).

- It lowers the carrying value (book value) of the asset on the balance sheet.

- Only tangible assets with limited useful life are depreciated. Land is not depreciated.

Simple Example

You buy a delivery van for Rs 50,000 that you expect to use for 5 years.

Each year you record:

Depreciation Expense → Rs 10,000 (hits Profit & Loss)

Accumulated Depreciation → Rs 10,000 (reduces the van’s value on Balance Sheet)

After 5 years, the van’s book value is zero (or salvage value), even if it’s still working.

In short: Depreciation recognizes that fixed assets “wear out” over time and ensures profits are not overstated in early years.

What Is Journal Entry For Depreciation?

The standard journal entry to record depreciation in accounting is very simple and is made at the end of each accounting period (monthly, quarterly, or annually).

Example:-

A company depreciates its machinery by Rs 12,000 for the current year.

12-5-2025 Depreciation Expense A/c ———————- Dr 12000

To Accumulated Depreciation A/c———————— Cr 12000

Explanation

- Depreciation Expense: An expense account → appears on the Income Statement → reduces profit for the period.

- Accumulated Depreciation: A contra-asset account → appears on the Balance Sheet → reduces the carrying value of the fixed asset (Cost − Accumulated Depreciation = Net Book Value).

This entry is the same regardless of the depreciation method (straight-line, diminishing balance, units of production, etc.) – only the amount changes.

Example Of Depreciation

Scenario

ABC Ltd buys a delivery truck on January 1, 2025.

- Purchase cost (excluding taxes): Rs 80,000

- Expected useful life: 5 years

- Estimated salvage value (scrap value at the end): Rs 10,000

- Depreciation method: Straight-line

Step 1: Calculate annual depreciation

Depreciable amount = Cost − Salvage value

= Rs 80,000 − Rs 10,000 = Rs 70,000

Annual depreciation = Rs 70,000 ÷ 5 years = Rs 14,000 per year

Step 2: Journal Entry every year (for 5 years)

On December 31 each year:

| Date | Particulars | Debit | Credit |

|---|---|---|---|

| 31-12-2025 | Depreciation Expense Truck | 14000 | |

| Accumulated Depreciation Truck | 14000 |

| Year | Depreciation Expense (P&L) | Accumulated Depreciation (Balance Sheet) | Net Book Value of Truck |

|---|---|---|---|

| 2025 | Rs 14,000 | Rs 14,000 | Rs 80,000 s 14,000 − R= Rs 66,000 |

| 2026 | Rs 14,000 | Rs 28,000 | Rs 52,000 |

| 2027 | Rs 14,000 | Rs 42,000 | Rs 38,000 |

| 2028 | Rs 14,000 | Rs 56,000 | Rs 24,000 |

| 2029 | Rs 14,000 | Rs 70,000 | Rs 10,000 (salvage value) |

Different Methods For Calculation Of Depreciation

Here are the most commonly used depreciation methods in accounting, with formulas and practical examples (using the same truck from earlier: Cost Rs 80,000, Salvage value Rs 10,000, Useful life 5 years).

| Method | Formula | Annual Depreciation | Key Feature |

|---|---|---|---|

| Straight-Line (Most common) | (Cost − Salvage) ÷ Useful life | Rs 70,000 ÷ 5 = Rs 14,000 every year | Same amount each year |

| Diminishing Balance / Declining Balance (Accelerated) | Book value at start of year × Depreciation rate

Common rate: 2 × Straight-line rate = 40% (Double Declining) |

Year 1: Rs 80,000 × 40% = Rs 32,000

Year 2: Rs 48,000 × 40% = Rs 19,200 Year 3: Rs 28,800 × 40% = Rs 11,520 Year 4: Rs 17,280 × 40% = Rs 6,912 Year 5: adjusted to reach salvage |

Higher expense in early years |

| Double Declining Balance (Popular accelerated method) | 2 × (1 ÷ Useful life) × Book value at start of year | Same as above (40% rate) | Ignores salvage until last year |

| Units of Production (Activity-based) | (Cost − Salvage) × (Units used this year ÷ Total estimated units) | Assume truck will drive 100,000 km total

Year 1: 30,000 km → Rs 70,000 × 30% = Rs 21,000 Year 2: 25,000 km → Rs 17,500 etc. |

Based on actual usage (km, hours, units produced) |

| Sum-of-the-Years’-Digits (SYD) (Accelerated) | (Cost − Salvage) × (Remaining life ÷ Sum of years 1 to 5)

Sum = 15 (5+4+3+2+1) |

Year 1: Rs 70,000 × 5/15 = Rs 23,333

Year 2: Rs 70,000 × 4/15 = Rs 18,667 Year 3: Rs 70,000 × 3/15 = Rs 14,000 etc. |

Front-loaded, but smoother than declining balance |

Which Methods Should You Employ?

Depreciation Entry In Accounting and its selection of methods entirely depends on the fact that what is your goal and it depends on your business type.

| Situation/Goal | Best Method To Use | Why |

|---|---|---|

| You want simplicity and clean financial statements | Straight-Line | Easiest to calculate, understand, and explain to investors/banks |

| You want to maximize tax deductions early (common in many countries) | Double Declining Balance or Diminishing Balance | Higher expense in first few years → lower taxable profit early on |

| The asset wears out based on usage, not time (trucks, machines, printers) | Units of Production | Matches expense exactly to actual wear and tear → most accurate |

| You need an accelerated method but smoother than double declining | Sum-of-the-Years’-Digits (SYD) | Front-loads depreciation but not as aggressively as double declining |

| Required by local tax authorities | Whatever the tax law mandates (often accelerated) | Tax rules override accounting preference (e.g., many countries force declining balance or special rates for tax) |

| Reporting under IFRS or Indian Accounting Standards | Usually Straight-Line (most acceptable) | Regulators and auditors prefer straight-line unless another method is clearly justified |

| You are a startup or high-growth company wanting higher early profits on paper | Straight-Line (or even longer useful life) | Lower early depreciation → higher reported profits → looks better to investors |

| The asset becomes obsolete very fast (computers, smartphones, tech equipment) | Double Declining or SYD | Quickly writes off value before the asset becomes worthless. |

Most Common Real-World Choices

- 99% of small and medium businesses: Straight-Line (simple and accepted everywhere)

- Tax books in many countries (India, USA, etc.): Accelerated methods (to save tax early)

- Manufacturing / transport companies: Units of Production for heavy machinery and vehicles

- Listed companies: Almost always Straight-Line for financial reporting

Golden Rule: Once you choose a method for an asset class, you must apply it consistently year after year (changing methods requires justification and disclosure).

So, for most people: Start with Straight-Line unless you have a strong reason (tax savings or usage pattern) to choose something else.

What Is Accumulated Depreciation?

Accumulated Depreciation is the total amount of depreciation expense that has been recorded against a fixed asset from the date it was purchased (or put into use) up to the current date.

It is a contra-asset account — meaning it has a credit balance and is shown on the Balance Sheet as a deduction from the original cost of the asset.

Simple Example (Delivery Truck)

- Original cost of truck: Rs 80,000

- Depreciation recorded so far: Rs 42,000 (3 years × Rs 14,000 per year)

| Fixed Assets | Amount |

|---|---|

| Truck (at cost) | Rs80,000 |

| Less: Accumulated Depreciation | (Rs42,000) |

| Net Book Value (Carrying Value) | Rs38,000 |

Formula Of Accumulated Depreciation

Accumulated Depreciation = Total depreciation expense recorded from the date of acquisition (or placement in service) up to the current date.

| Situation | Formula |

|---|---|

| General Formula | Accumulated Depreciation = Annual Depreciation × Number of Years Expired |

| With Partial Year | Accumulated Depreciation = Annual Depreciation × Number of Years + (Monthly Depreciation × Months in Current Year) |

| Straight-Line Method | Accumulated Depreciation = (Cost − Salvage Value) ÷ Useful Life in Years × Years Used So Far |

| At Any Specific Date | Accumulated Depreciation = Depreciation Expense of Year 1+ Year 2 + year 3+……….+ Current Period. |

Few insightful articles on Accounts to improve your knowledge:

- Income From House Property: A Guide To The Tax Payer

- Top 30 Journal Entries Questions And Answers

- Can Science Students Become An Accountant?

- All You Need To Know About Audit Trail In Zoho Books

- What Is General Ledger Accounting And How Does It Work?

- Guide To AI In Accounting: Trends, Tools, And Stats

Importance For The Calculation For Depreciation

There are certain core importance of calculation for depreciation that you should be well aware of. Some of its core importance of Depreciation are as follows:-

1. Accurate Profit Measurement

Without depreciation, a company buying a Rs 100,000 machine would show the full Rs 100,000 as an expense in Year 1 → huge loss or very low profit that year, then unrealistically high profits in later years. Depreciation spreads the cost → profits are realistic and comparable year after year.

2. Correct Asset Valuation On The Balancesheet

The true worth of fixed assets decreases over time. Showing assets at original cost minus Accumulated Depreciation (Net Book Value) gives a fair picture of what the assets are actually worth today.

3. Tax Savings

In almost every country, depreciation is a tax-deductible expense. Proper calculation reduces taxable income → lower tax bills (especially important when using accelerated methods).

4. Better Decision Making

- Management knows when assets are nearing the end of their useful life → plan replacements. Depreciation entry in Accounting is essential for brand development and it is crucial for record keeping.

- Investors and banks see realistic profits and asset values instead of distorted figures.

5. Compliance With Accounting Standards

IFRS, Ind AS, US GAAP, and all major accounting frameworks make depreciation mandatory for tangible fixed assets. Non-compliance leads to qualified audit reports or penalties.

6. Correct Pricing & Cost Control

Many companies include depreciation in product costing. Accurate depreciation ensures products are correctly priced (not too low → loss, not too high → uncompetitive).

7. Calculation Of Gain/ Loss On Sale Of Asset

When you sell an old asset, profit or loss = Sale price − Net Book Value (Cost − Accumulated Depreciation). Wrong depreciation → wrong profit/loss figure.

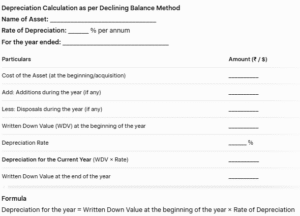

Format For Calculation Of Depreciation

You only need to follow this straightforward standard format for calculating depreciation under its various methods. The universally accepted layouts for computing depreciation using different approaches are presented below:

1. Straight Line Method

The general and standard format for straight line method of Depreciation that you must know from your end. Some of the core format you must know here are as under:-

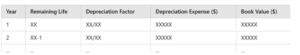

2. Declining Balance Method

The general and standard format for straight line method of Depreciation that you must know from your end. Some of the core formats you must know here are as under:-

3. Sum Of Years’ Digits Methods

The formula for calculating in this method is

Depreciation Expense =(Remaining Life Of An Asset – x (Cost – Salvage value))/Sum Of the year’s digits

4. Units Of Production Methods

The formula for calculating in this method is

Depreciation Per unit = (Cost of Assets – Salvage Value)/Total Estimated Unit

Depreciation expense = depreciation per unit x units produced.

5. Double Declining Balance Methods

The formula for calculating in this method is as under:-

Depreciation = 2x(1/ useful life) x book value

Impact Of Depreciation On Financial Statement

Depreciation is the process of spreading the cost of a fixed asset (like machinery, vehicles, buildings, etc.) over its useful life. It is a non-cash expense, meaning no actual cash leaves the company when depreciation is recorded. However, it significantly affects all three main financial statements.

1. Impact On The Income Statement (Profit & Loss Account)

- Depreciation is shown as an expense.

- It reduces the company’s operating profit and net profit for the year.

- Even though no cash is paid, profit appears lower because of this expense.

- Result: Lower net income → Lower earnings per share (EPS) → May make the company look less profitable on paper.

2. Impact On The Balance Sheet

- The original cost of the asset (gross value) stays the same.

- A contra-account called “Accumulated Depreciation” increases every year.

- Net book value of the asset = Original cost − Accumulated depreciation → This value decreases over time.

- Since profit is lower, retained earnings (part of shareholders’ equity) also decrease.

- Overall effect: Total assets decrease and total equity decreases.

3. Impact On The Cash Flow Statement

- Depreciation does not involve cash outflow, so it is added back to net profit in the operating activities section (when using the indirect method).

- This makes cash flow from operations look much stronger than the reported net profit.

- Companies with heavy assets (e.g., manufacturing, airlines, telecom) often show high cash flow even when profits are low — this is normal and due to depreciation.

Frequently Asked Questions

1. What is the basic journal entry for recording depreciation?

Answer:

The standard journal entry to record depreciation every month or year is:

| Date | Particulars | Debit (₹) | Credit (₹) |

|---|---|---|---|

| Depreciation Expense A/c Dr. | XXX | ||

| To Accumulated Depreciation A/c | XXX |

(Depreciation expense goes to the Income Statement, and Accumulated Depreciation is shown on the Balance Sheet as a contra-asset.)

2. Why do we credit Accumulated Depreciation instead of directly crediting the Asset account?

Answer:

We use Accumulated Depreciation (a contra-asset account) so that:

- The original cost of the asset remains visible on the balance sheet (important for records and audits).

- We can separately track how much of the asset has been “used up”.

- Net Book Value = Original Cost − Accumulated Depreciation is clearly shown.

Directly crediting the asset account would erase the historical cost, which is not allowed under accounting standards.

3. Is depreciation a cash expense or non-cash expense?

Answer:

100% Non-Cash Expense.

No cash actually leaves the company when depreciation is recorded. The cash was spent when the asset was originally purchased. Depreciation only allocates that past cost over time.

4. Where does depreciation appear in the final accounts?

Answer:

- Income Statement: Depreciation Expense → reduces Profit

- Balance Sheet:

- Asset shown at original cost

- Less: Accumulated Depreciation

- Net amount = Carrying Value / Book Value

- Cash Flow Statement (Indirect Method): Added back to Net Profit in Operating Activities

5. Can we pass a single combined entry by directly reducing the asset value? (Common misconception)

Answer:

No, this is incorrect and not allowed under proper accounting principles.

Wrong entry (never do this):

- Depreciation Expense Dr. To Asset A/c

This violates the historical cost principle. Always use Accumulated Depreciation as a separate contra account.

Final Takeaway

Hence, these are some crucial depreciation entry in accounting that you must know from your end. As this concept is essential for maintaining correct records in books of accounts. Additionally, you cannot make your choices in the dark.

You can share your comments and views in our comment box. This will help us to know your take on this matter. Ensure that you follow the correct choices from your counterpart.

- 3 Smart Ways to Speed Up Data Entry and Processing in Excel - January 27, 2026

- How to Convert Images Containing Tables into Editable Excel - January 27, 2026

- One Nation, One ID: Understanding the Academic Bank of Credits - January 22, 2026