Why Smart Finance Pros Are Rushing To Learn SAP FICO

In today’s digital economy, SAP FICO—SAP’s Financial Accounting and Controlling module—stands as the gold standard for enterprise resource planning (ERP) in finance. Why smart finance pros are rushing to learn SAP FICO will no longer be a puzzle for you once you read this article. Savvy professionals are flocking to master it amid surging demand from MNCs and global firms adopting SAP S/4HANA for real-time insights, automation, and compliance.

This expertise unlocks high-paying roles like FICO consultants, with salaries often exceeding $100K, and 100% placement opportunities via specialized training. As AI integrates into ERP workflows, SAP FICO skills future-proof careers, enabling seamless data management, fraud detection, and strategic forecasting.

From B.Com grads to seasoned accountants, learning SAP FICO isn’t just an upgrade—it’s a launchpad for global mobility and innovation in finance.

Table of Contents

Why Learning SAP FICO Is Important Today?

The demand for SAP FICO professionals in India is surging, fueled by the country’s rapid digital transformation, S/4HANA migrations, and a booming IT services sector. India hosts over 2,000 SAP customers, with FICO being the most sought-after module due to regulatory compliance needs and real-time financial analytics.

As of October 2025, LinkedIn lists 6,000+ SAP FICO consultant jobs nationwide, up 20% from 5,000 in Q4 2024, reflecting heightened hiring amid a talent shortage estimated at 50,000+ specialists.

Naukri.com shows 2,850 active postings, a 15% YoY increase, concentrated in hubs like Bengaluru (1,000+ openings). Salaries underscore the boom: Average pay for consultants is ₹6.8 lakhs annually, with entry-level at ₹3.3-13 lakhs and seniors exceeding ₹15 lakhs, a 10-12% rise from 2024 due to demand.

Gartner’s 2025 forecast predicts 18% ERP growth in India, amplifying FICO roles by 25% through 2027.

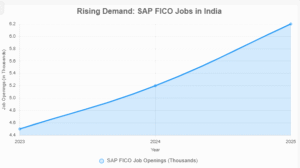

Graphical Representation: Growth in SAP FICO Job Openings in India (2023-2025)

This chart projects a 38% growth from 2023 baselines (e.g., ~4,500 postings) to 2025’s 6,200+, based on LinkedIn/Naukri trends and industry reports. The upward trajectory highlights India’s pivotal role in global SAP implementations.

Why Are The Demand For SAP FICO Professionals Increasing Today?

The demand for SAP FICO (Financial Accounting and Controlling) professionals in India is experiencing a significant surge, driven by a confluence of technological, economic, and industry-specific factors. As India solidifies its position as a global IT and SAP hub, the need for skilled FICO professionals is at an all-time high.

Below, we explore the key reasons behind this trend, supported by data and insights, to provide a comprehensive understanding of why SAP FICO expertise is increasingly sought after in India today.

1. Rapid Adoption Of SAP S/4 HANA

India is a key market for SAP, with over 2,000 organizations, including MNCs and mid-sized firms, relying on SAP systems for financial management.

The transition from SAP ECC to S/4HANA, SAP’s next-generation ERP platform, is accelerating due to its in-memory database capabilities, which enable real-time financial analytics and automation.

With SAP’s ECC support ending in 2027, companies are under pressure to migrate, requiring FICO professionals to configure and optimize financial modules.

This shift has led to a 20% year-over-year increase in FICO job postings, with LinkedIn reporting over 6,000 active SAP FICO roles in India as of October 2025, up from 5,000 in Q4 2024.

2. India’s Role In Global Digital Transformation

India’s IT services sector, valued at $254 billion in 2024, is a global leader in ERP implementations. SAP FICO aligns with India’s digital transformation agenda, driven by Industry 4.0 and government initiatives like Digital India.

FICO’s ability to streamline financial processes, such as general ledger management and GST compliance, makes it critical for businesses modernizing operations.

Gartner’s 2025 forecast projects an 18% growth in ERP spending in India, with financial modules like FICO leading the charge. Professionals skilled in FICO are essential for implementing these systems, driving demand in cities like Bengaluru, Hyderabad, and Pune.

3. Acute Talent Shortage

A significant skills gap is amplifying demand for SAP FICO professionals in India. Industry estimates indicate a shortage of over 50,000 SAP specialists, with FICO roles accounting for a substantial portion due to their complexity and criticality.

Naukri.com lists 2,850 active FICO job postings in 2025, a 15% increase from 2024, with Bengaluru alone hosting over 1,000 openings. This scarcity ensures high employability, with training programs boasting near 100% placement rates for certified professionals.

4. Regulatory Compliance & GST Registration

India’s complex regulatory landscape, particularly the Goods and Services Tax (GST) framework introduced in 2017, has increased the need for SAP FICO expertise.

FICO’s financial accounting tools enable seamless GST compliance, e-invoicing, and tax reporting, which are critical for businesses across sectors like manufacturing, retail, and logistics.

Additionally, compliance with international standards like IFRS further drives demand for professionals who can configure FICO to meet these requirements. This regulatory complexity makes FICO skills indispensable, as companies seek to avoid penalties and ensure financial transparency.

5. Integration With Emerging Technologies

SAP S/4HANA’s integration with AI, machine learning, and predictive analytics enhances FICO’s value in India’s tech-driven market.

Features like AI-powered fraud detection in accounts payable and predictive cost analysis in controlling are transforming financial management.

As Indian firms adopt these technologies, FICO professionals who can leverage these tools are in high demand. Job postings increasingly emphasize S/4HANA expertise, with a 15% YoY rise in roles requiring advanced FICO skills, particularly in tech hubs.

6. Lucrative Salaries & Career Opportunities

SAP FICO roles in India offer competitive salaries, making them highly attractive. Entry-level consultants earn ₹3.3-13 lakhs annually, while senior professionals command ₹15 lakhs or more, reflecting a 10-12% salary increase from 2024 due to demand.

Certifications like SAP Certified Application Associate – SAP S/4HANA Financial Accounting enhance employability, opening doors to roles with MNCs, consulting firms like TCS, Infosys, and Deloitte, and SAP implementation partners.

The global applicability of FICO skills also enables professionals to pursue international opportunities, particularly in the U.S., Europe, and the Middle East.

7. Growth Of SAP Implementation Partners

India’s IT giants—Infosys, TCS, Wipro, and HCL—are major SAP implementation partners, servicing global clients transitioning to S/4HANA. These firms are scaling up hiring to meet client demands, particularly in financial modules.

Bengaluru, a global SAP hub, accounts for over 1,000 FICO job openings, with similar trends in Hyderabad and Mumbai.

The 2027 ECC-to-S/4HANA migration deadline is accelerating recruitment, as companies rush to upgrade systems, requiring FICO experts for configuration, testing, and support.

8. Versatility Across Industries

SAP FICO’s applicability spans diverse industries, including manufacturing, IT, pharmaceuticals, and retail, which are thriving in India.

Professionals can work in roles like FICO consultants, financial analysts, GST specialists, or ERP project managers. This versatility attracts a wide range of candidates, from B.Com and MBA graduates to experienced accountants and IT professionals transitioning to ERP roles.

The ability to bridge finance and technology makes FICO skills highly valued in India’s hybrid job market.

9. Government & SME Adoption

Small and medium enterprises (SMEs) in India are increasingly adopting SAP solutions like SAP Business One and S/4HANA to compete globally. Government initiatives promoting digitalization, coupled with schemes like MSME digital transformation, are driving SAP adoption among smaller firms.

FICO professionals are needed to customize solutions for these businesses, particularly for financial reporting and compliance, further boosting demand.

Few related topics for your knowledge

- SAP FICO Vs SAP HANA: Which Is Better

- Analyzing The Procure To Pay Process: A Comprehensive Overview

- How SAP FICO Works In Manufacturing Industry

- Streamlining the Accounts Payable Process in SAP

- Year End Activities In SAP FICO: An In-depth Analysis

- 50+ SAP MM Interview Questions and Answers Revealed

What Smart Finance Pros Are Rushing To Learn SAP FICO?

Learning SAP FICO (Financial Accounting and Controlling) opens up a wealth of career prospects in India and globally, driven by the increasing demand for ERP expertise in a digital-first economy. As businesses adopt SAP S/4HANA and prioritize financial efficiency, FICO professionals are positioned for high-paying, versatile, and future-proof roles.

Below, we explore the key career opportunities, salary potential, job roles, and long-term benefits of mastering SAP FICO, with a focus on India’s thriving job market and global opportunities.

1. High Paying Job Roles

SAP FICO expertise commands competitive salaries due to the specialized nature of the skills and the ongoing talent shortage. Why smart finance pros are rushing to learn SAP FICO will no longer be a puzzle for you.

In India, entry-level FICO consultants earn between ₹3.3-13 lakhs per annum, while experienced professionals, such as senior consultants or solution architects, can earn ₹15-30 lakhs annually, reflecting a 10-12% salary increase from 2024 due to rising demand.

Globally, particularly in the U.S., salaries range from $100,000 to $150,000 annually, with top-tier roles exceeding $200,000 for freelancers or senior consultants. This financial reward makes SAP FICO a lucrative career choice for fresh graduates (B.Com, BBA, MBA) and seasoned finance or IT professionals.

2. Diverse Job Roles

SAP FICO skills enable professionals to pursue a variety of roles across finance and IT domains, leveraging the module’s applicability in financial accounting and controlling. Key roles include:

- SAP FICO Consultant: Configures and implements FICO modules for clients, ensuring alignment with business needs like GST compliance or IFRS reporting. In India, LinkedIn lists over 6,000 active FICO consultant jobs as of October 2025, with Bengaluru alone hosting 1,000+ openings.

- Financial Analyst: Uses FICO’s real-time analytics for budgeting, forecasting, and profitability analysis, bridging finance and strategic decision-making.

- ERP Project Manager: Oversees SAP implementation projects, coordinating FICO integration with other modules like SCM or HCM.

- GST Specialist: Customizes FICO for India-specific tax compliance, a critical need given the complexity of GST regulations.

- SAP Solution Architect: Designs end-to-end SAP solutions, commanding premium salaries due to the role’s strategic importance.

- Systems Auditor: Ensures compliance and accuracy in financial systems, leveraging FICO’s reporting tools.

These roles span industries like IT, manufacturing, retail, pharmaceuticals, and banking, offering versatility and career flexibility.

3. Global Career Mobility

SAP’s global footprint, with over 80% of Fortune 500 companies using its systems, ensures that FICO skills are transferable across borders.

Indian professionals can work with MNCs like Deloitte, Accenture, TCS, Infosys, or Wipro, either domestically or in markets like the U.S., Europe, or the Middle East.

The global shortage of over 50,000 SAP specialists in India and 100,000 worldwide amplifies opportunities for international placements. Certifications like SAP Certified Application Associate – SAP S/4HANA Financial Accounting enhance credibility, making professionals highly sought after globally.

4. High Employability & Placement Rates

The acute demand for FICO professionals, driven by the 2027 ECC-to-S/4HANA migration deadline, ensures near 100% placement rates for certified individuals.

Training institutes in India report that graduates of SAP FICO courses are quickly absorbed by IT firms, SAP partners, and corporate clients.

Naukri.com lists 2,850 active FICO job postings in 2025, a 15% increase from 2024, indicating robust hiring trends. This employability is particularly appealing for fresh graduates and career switchers from finance or IT backgrounds.

5. Future-Proof Career With Emerging Technologies

SAP FICO’s integration with AI, machine learning, and predictive analytics in S/4HANA positions professionals at the forefront of technological innovation.

Expertise in AI-driven features like fraud detection in accounts payable or predictive cost analysis ensures relevance in an increasingly automated world.

Gartner’s 2025 forecast of 18% ERP growth in India underscores the growing reliance on FICO for advanced financial management. As businesses adopt cloud-based SAP solutions and explore trends like blockchain for financial transparency, FICO professionals remain future-ready.

6. Opportunities With SAP Implementation Partners

India’s IT services giants—Infosys, TCS, Wipro, and HCL—are major SAP implementation partners, servicing global clients transitioning to S/4HANA.

These firms are aggressively hiring FICO professionals to meet client demands, with Bengaluru alone accounting for over 1,000 job openings.

The 2027 S/4HANA migration deadline is accelerating recruitment, as companies require experts for configuration, testing, and support, creating a steady pipeline of opportunities.

7. SME And Government Sector Growth

Beyond MNCs, small and medium enterprises (SMEs) in India are adopting SAP solutions like SAP Business One and S/4HANA to compete globally.

Government initiatives like Digital India and MSME digitalization are driving ERP adoption among smaller firms, increasing the need for FICO professionals to customize financial solutions.

This broadens the job market, as FICO experts are needed not only in corporate giants but also in growing SMEs.

8. Long Term Career Growth

SAP FICO skills pave the way for long-term career progression. Entry-level consultants can advance to senior roles like SAP Lead Consultant, Solution Architect, or Program Manager within 5-10 years, with salaries doubling or tripling.

Continuous learning through advanced certifications (e.g., S/4HANA Cloud Finance) and upskilling in related modules like SAP MM or SD further enhances growth potential.

The global SAP ecosystem ensures sustained demand, offering job security even in economic downturns.

9. Bridging Finance And IT

SAP FICO is unique in bridging finance and IT, making it ideal for professionals seeking hybrid careers. Accountants can transition to tech-driven roles, while IT professionals can specialize in ERP, increasing their marketability.

This interdisciplinary appeal attracts diverse candidates, from B.Com graduates to IT engineers, fostering career resilience in a dynamic job market.

Fast Track Your Career with Professional SAP Training |

|||

| SAP Certification Courses | |||

| Explore All SAP Courses SAP FICO Course online | SAP MM Course Online | SAP PP Course Online | SAP SD Course Online |

|||

Job Roles Available After Learning SAP FICO

Learning SAP FICO (Financial Accounting and Controlling) equips professionals with skills to pursue a variety of high-demand job roles in India and globally, bridging finance and technology. The surge in SAP S/4HANA adoption, with over 2,000 SAP customers in India and a global talent shortage of over 50,000 SAP specialists, creates diverse opportunities across industries like IT, manufacturing, retail, banking, and pharmaceuticals.

Below is a detailed list of key job roles available after mastering SAP FICO, along with their responsibilities, salary ranges, and market relevance as of October 21, 2025.

1. SAP FICO Consultant

- Responsibilities: Configures and implements SAP FICO modules (Financial Accounting and Controlling) to meet client needs, including general ledger, accounts payable/receivable, asset accounting, cost center accounting, and profitability analysis. Handles system customization, testing, and user training, ensuring compliance with regulations like GST in India or IFRS globally.

- Salary Range: In India, ₹3.3-13 lakhs per annum for entry-level, ₹15-30 lakhs for senior consultants. In the U.S., $100K-$150K annually, with freelancers earning up to $200K.

- Market Demand: High, with 6,000+ active job postings in India (LinkedIn, October 2025) and 3,000+ in the U.S., driven by S/4HANA migrations and a 15% YoY increase in demand. Bengaluru alone lists 1,000+ openings.

- Employers: MNCs (Deloitte, Accenture), IT firms (TCS, Infosys, Wipro), and SAP implementation partners.

2. SAP Financial Analyst

- Responsibilities: Leverages FICO’s real-time analytics for budgeting, forecasting, variance analysis, and profitability reporting. Uses tools like SAP Profitability Analysis (CO-PA) to provide insights for strategic decision-making, supporting cost optimization and financial planning.

- Salary Range: In India, ₹5-12 lakhs for mid-level roles, up to ₹20 lakhs for seniors. In the U.S., $80K-$120K.

- Market Demand: Growing, as businesses prioritize data-driven finance. Common in industries like manufacturing and retail, with roles often embedded in corporate finance teams.

- Employers: Corporations (Reliance, Tata), consulting firms, and SMEs adopting SAP Business One.

3. SAP GST Specialist

- Responsibilities: Customizes SAP FICO for India-specific tax compliance, particularly Goods and Services Tax (GST), e-invoicing, and tax reporting. Ensures accurate tax calculations, filings, and integration with government portals like GSTN.

- Salary Range: In India, ₹4-10 lakhs for entry-level, ₹12-18 lakhs for experienced specialists.

- Market Demand: Strong in India due to GST’s complexity, with roles concentrated in finance-heavy sectors like logistics and manufacturing. Naukri.com lists 2,850 FICO-related jobs, many requiring GST expertise.

- Employers: Indian firms, SAP partners, and MNCs with India operations (HUL, Aditya Birla).

4. SAP ERP Project Manager

- Responsibilities: Oversees SAP implementation projects, coordinating FICO integration with modules like SAP MM (Materials Management) or SD (Sales and Distribution). Manages timelines, budgets, and stakeholder communication, ensuring successful rollouts.

- Salary Range: In India, ₹10-25 lakhs; in the U.S., $120K-$180K.

- Market Demand: Rising with the 2027 ECC-to-S/4HANA deadline, as companies rush to upgrade systems. Ideal for FICO professionals with 5+ years of experience.

- Employers: Consulting firms (EY, PwC), IT services (HCL, Capgemini), and large enterprises.

5. SAP Solution Architect

- Responsibilities: Designs end-to-end SAP solutions, integrating FICO with other modules to align with business goals. Provides strategic guidance on system architecture, scalability, and S/4HANA migrations.

- Salary Range: In India, ₹20-40 lakhs; in the U.S., $150K-$250K.

- Market Demand: High for senior professionals, driven by complex S/4HANA projects and a global shortage of architects.

- Employers: Global consultancies, SAP partners, and Fortune 500 firms.

6. SAP Systems Auditor

- Responsibilities: Audits SAP FICO systems to ensure compliance with regulations (e.g., IFRS, GAAP, GST), data integrity, and security. Identifies risks and optimizes financial processes using FICO’s reporting tools.

- Salary Range: In India, ₹6-15 lakhs; in the U.S., $90K-$130K.

- Market Demand: Steady, particularly in regulated industries like banking and pharmaceuticals, where compliance is critical.

- Employers: Audit firms (KPMG, Grant Thornton), banks, and corporate finance teams.

7. SAP Functional Analyst

- Responsibilities: Bridges business requirements and technical solutions, analyzing client needs to configure FICO modules. Supports end-users, troubleshoots issues, and optimizes system performance.

- Salary Range: In India, ₹5-14 lakhs; in the U.S., $85K-$125K.

- Market Demand: Strong, as businesses seek analysts to ensure smooth SAP operations post-implementation.

- Employers: SAP clients, IT services firms, and in-house corporate IT teams.

8. SAP Trainer/ Freelance Consultant

- Responsibilities: Trains clients or employees on SAP FICO functionalities or provides freelance consulting for short-term projects like system upgrades or module implementations.

- Salary Range: In India, ₹8-20 lakhs (freelance rates vary); in the U.S., $50-$150/hour for freelancers.

- Market Demand: Growing, as companies invest in upskilling staff for S/4HANA. Freelance opportunities are rising with project-based needs.

- Employers: Training institutes, SAP partners, or direct clients.

Final Takeaway

Hence, these are some of the core reasons why Smart finance Pros are rushing to learn SAP FICO. Additionally, you cannot make your choices on the wrong end. Here, proper planning can help you to meet your goals with complete ease.

You can share your views and opinions in our comment box. This will help us to know your take on this matter. Here, proper application of career strategy can make things easier for you.

- One Nation, One ID: Understanding the Academic Bank of Credits - January 22, 2026

- Mastering Power Query In Excel: Step By Step Guide - December 29, 2025

- 50+ SAP MM Interview Questions and Answers Revealed - December 19, 2025