Year End Activities In SAP FICO: An In-depth Analysis

Year end activities in SAP FICO is quite a complex process. These activities involve closing the fiscal year, reconciling accounts, and preparing financial statements. Now, it sounds quite complex and while you implement the process it becomes more complex. So you need to break down your work step by step.

Key tasks include finalizing general ledger postings, clearing open items, and performing balance carryforwards to transfer account balances to the new fiscal year.

Asset accounting requires depreciation runs, asset value adjustments, and verification of fixed asset records. In controlling, cost center assessments, profit center allocations, and internal order settlements are completed to reflect accurate cost distributions. Additionally, accruals, provisions, and foreign currency valuations are processed to align with accounting standards.

Table of Contents

Understanding Year-End Activities In SAP FICO

The accounting team is responsible for executing periodic system closures in SAP S/4HANA Finance at the end of each month and fiscal year. As an SAP S/4HANA Finance consultant, you must have an in-depth understanding of these closure procedures to ensure seamless execution.

The fiscal year-end closure in SAP Financial Accounting aligns with the predefined fiscal year variants and calendars configured during system implementation. The specific steps vary across organizations based on their unique software configurations and operational needs. Year end activities in SAP FICO can help you to understand the current status of your finance.

Nonetheless, most companies adhere to standardized protocols to close the core submodules in SAP Financial Accounting. Gain thorough expertise in the SAP Year-End Closing Process through a concise course that walks you through each stage, including key transactions and program interfaces.

Prior to diving into this SAP Year-End Closing Process tutorial, ensure you are well-versed in the SAP Month-End Closing Process guide.

Benefits Of Simplifying Year-End Activities Of SAP FICO

There are several benefits of simplifying the year-end activities in SAP FICO. Some of the key benefits of it are as follows:-

1. Improved Accuracy In Financial Reporting

- Reduces manual errors in journal entries, reconciliations, and closing balances.

- Ensures compliance with accounting standards and audit requirements.

2. Faster Closing Cycles

- Automation and streamlined workflows cut down the time needed to close books.

- Enables quicker transition into the new fiscal year with minimal disruption.

3. Enhanced Decision Making

- Clean, timely reports provide better insights for strategic planning.

- Historical data is more reliable for forecasting and budgeting.

4. Stronger Compliance And Risk Management

- Ensures regulatory deadlines are met (e.g., tax filings, statutory audits).

- Minimizes risks of penalties due to late or inaccurate submissions.

5. Seamless Balance carry Forward

- Simplifies the transfer of G/L, customer, vendor, and asset balances to the next fiscal year.

- Reduces reconciliation headaches in the new period.

6. Better Collaboration Across Departments

- Clear task ownership and automated workflows improve coordination between finance, IT, and operations.

- Reduces bottlenecks and last-minute firefighting.

Year-End Activities In SAP FICO

Year-end activities in SAP Financial Accounting and Controlling (FICO) are critical for closing financial books, ensuring compliance, and preparing for the new fiscal year. These tasks involve handling specific reports, transactions, and procedures to finalize the financial period and transfer balances. Below is a comprehensive overview of the key year-end activities in SAP FICO, based on standard protocols and best practices:

1. Run Financial Statements

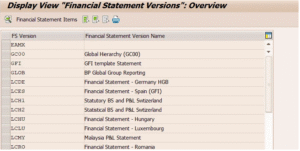

- Generate key financial statements such as the balance sheet, income statement, and cash flow statement using SAP reporting tools (e.g., Financial Statement Version or Report Painter).

- Verify the accuracy of the numbers and investigate significant variances to ensure the financial data is correct.

- Ensure compliance with international accounting standards (e.g., IFRS, US GAAP) or local regulations (e.g., HGB).

2. Tax Reports

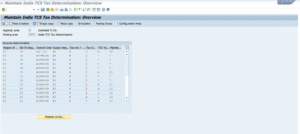

- Prepare detailed tax-related reports, including tax forms and financial statements.

- Ensure all transactions reflect the most up-to-date tax rates and codes.

- Reconcile tax accounts to comply with regulatory requirements and avoid penalties.

3. Vendor And Customer Reconciliation

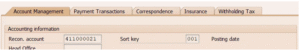

- Perform reconciliation of open items in Accounts Payable (FI-AP) and Accounts Receivable (FI-AR) to ensure balances match with vendor and customer statements.

- Clear open items (e.g., outstanding invoices, credit memos) and resolve discrepancies.

- This step ensures accurate financial reporting and prevents errors in the balance sheet.

4. Internal Order Settlement

- Settle costs associated with internal orders to the appropriate cost centers, projects, or profitability segments.

- Verify that settlements align with project requirements and budget constraints.

- This ensures accurate cost allocation for internal reporting and analysis.

5. Review Controlling Reports

- Analyze variance reports for cost centers and profit centers to identify deviations from planned budgets.

- Review profitability analysis (CO-PA) and product costing (CO-PC) reports to assess performance.

- These reports provide insights for strategic decision-making in the upcoming fiscal year.

6. Asset Accounting Activities

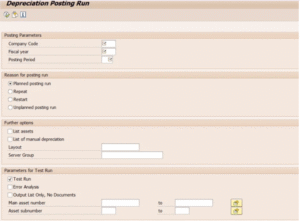

- Perform year-end asset accounting tasks, such as running depreciation for the fiscal year.

- In SAP S/4HANA, depreciation is calculated in real-time, but ensure planned depreciation values are updated for the new year after balance carryforward.

- Reconcile fixed asset balances and ensure proper valuation of assets.

7. General Ledger Activities

- Execute balance carryforward to transfer General Ledger balances to the new fiscal year.

- In SAP S/4HANA, the balance carryforward automatically includes new Asset Accounting balances, eliminating the need for a separate carryforward in FI-AA.

- Close the final fiscal period and open the new fiscal year in the General Ledger, adhering to predefined fiscal year variants and calendars.

8. Period End Closing

- Perform a traditional period-end close for the final fiscal period before the year-end close.

- Check both FI (Financial Accounting) and CO (Controlling) period statuses to ensure all postings are complete and aligned.

- In SAP S/4HANA, FI and CO are closed simultaneously using the Universal Journal (table ACDOCA), streamlining the process.

9. Bank Reconciliation

- Reconcile bank transactions with the Bank Ledger (FI-BL) to ensure all bank account data matches system records.

- Process any pending deposits, withdrawals, or transfers to finalize bank-related transactions.

10. Clearing Adjustments

- Clear GR/IR (Goods Receipt/Invoice Receipt) accounts to resolve open items related to procurement.

- Adjust accruals and deferrals to reflect accurate period-end financials.

- In SAP S/4HANA, some traditional adjustment activities (e.g., Profit and Loss Adjustment, Balance Sheet Adjustment) are no longer required due to real-time processing.

Few SAP related topics for your knowledge

- SAP FICO Vs SAP HANA: Which Is Better

- Analyzing The Procure To Pay Process: A Comprehensive Overview

- How SAP FICO Works In Manufacturing Industry

- Streamlining the Accounts Payable Process in SAP

- Order To Cash Process In SAP: Ways To Optimize The Financial Flows

- 50+ SAP MM Interview Questions and Answers Revealed

Month-End Activities In SAP FICO

Month-end activities in SAP Financial Accounting and Controlling (FICO) are essential for closing the financial period, ensuring accurate financial reporting, and preparing for the next period.

These tasks focus on reconciling accounts, posting adjustments, and validating data to maintain compliance and financial integrity. Below is a comprehensive overview of the key month-end activities in SAP FICO, based on standard practices and tailored to both SAP ECC and SAP S/4HANA environments.

1. Reconcile Sub Ledgers With General Ledger

- Ensure that sub-ledgers such as Accounts Payable (FI-AP), Accounts Receivable (FI-AR), and Asset Accounting (FI-AA) reconcile with the General Ledger (FI-GL).

- Use transactions like FAGLL03 (G/L Account Line Items) or FBL3N to verify balances and identify discrepancies.

- In SAP S/4HANA, the Universal Journal (table ACDOCA) integrates FI and CO, simplifying reconciliation.

2. Clear Open Items

- Clear open items in Accounts Payable (FI-AP) and Accounts Receivable (FI-AR) using transactions like F-44 (Vendor Clearing) and F-32 (Customer Clearing).

- Reconcile vendor and customer statements to resolve outstanding invoices, credit memos, or payments.

- Address GR/IR (Goods Receipt/Invoice Receipt) clearing using F.13 (Automatic Clearing) or MR11 (GR/IR Maintenance) to clear discrepancies in procurement accounts.

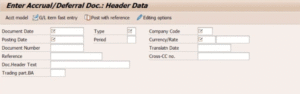

3. Post Accrual & Deferrals

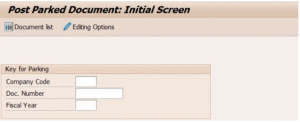

- Record accruals for expenses incurred but not yet invoiced (e.g., utilities, rent) using FBS1 (Enter Accrual/Deferral Document).

- Post deferrals for revenues or expenses recognized in future periods.

- In SAP S/4HANA, use the Accrual Engine for automated and streamlined accrual postings.

4. Run Depreciation For Fixed Assets

- Execute depreciation runs for fixed assets in Asset Accounting (FI-AA) using transaction AFAB.

- In SAP S/4HANA, depreciation is calculated in real-time, but verify planned depreciation values and post them for the period.

- Reconcile asset balances using reports like S_ALR_87011963 (Asset Balances).

5. Bank Reconciliation

- Reconcile bank accounts with the Bank Ledger (FI-BL) using transaction FF67 (Manual Bank Statement) or FEBP (Electronic Bank Statement).

- Ensure all bank transactions (deposits, withdrawals, fees) are posted and matched with system records.

- Clear any pending bank items to align with external bank statements.

6. Cost Center & Internal Order Settlements

- Settle costs from internal orders to cost centers, projects, or profitability segments using KO8G (Collective Settlement) or KO88 (Individual Settlement).

- Allocate overhead costs to cost centers using KSV5 (Distribution) or KSU5 (Assessment) in Controlling (CO).

- Verify cost center balances using reports like S_ALR_87013611 (Cost Centers: Actual/Plan/Variance).

Dominating the Future: Become a SAP Master |

|||

| SAP Certification Courses | |||

| Explore All SAP Courses SAP FICO Course online | SAP MM Course Online | SAP PP Course Online | SAP SD Course Online |

|||

7. Profitability Analysis

- Review profitability reports in CO-PA to analyze revenue, costs, and margins by market segments, products, or regions.

- Validate product costing data in CO-PC, ensuring standard costs and variances are accurate.

- Use transactions like KE30 (Execute Profitability Report) for CO-PA analysis.

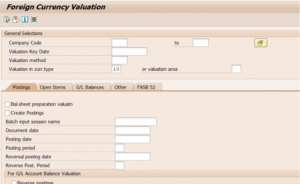

8. Foreign Currency Revaluation

- Revalue foreign currency accounts (e.g., bank accounts, receivables, payables) to account for exchange rate fluctuations using FAGL_FCV (Foreign Currency Valuation) in SAP S/4HANA or F.05 in SAP ECC.

- Post revaluation entries to reflect unrealized gains or losses in the General Ledger.

9. Period End Closing Of FI and CO

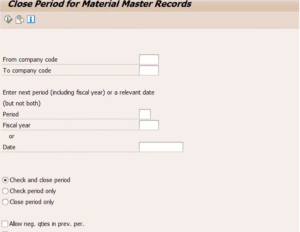

- Close the financial accounting period in FI using OB52 (Change Posting Periods) to prevent further postings in the closed period.

- In Controlling, close CO periods using OKP1 (Maintain Period Lock) to restrict CO postings.

- In SAP S/4HANA, FI and CO periods are closed simultaneously due to the Universal Journal, streamlining the process.

10. Run Financial Reports

- Generate key financial reports, such as trial balances (F.08), balance sheets, and profit and loss statements, using tools like S_ALR_87012284 (Financial Statements).

- Analyze variances and ensure data accuracy for internal and external reporting.

- Use SAP Fiori apps in S/4HANA for real-time reporting and analytics.

11. GR/ IR Account Maintenance

- Clear Goods Receipt/Invoice Receipt (GR/IR) accounts to resolve mismatches between goods received and invoices posted.

- Use MR11 to adjust small differences or clear old open items, ensuring accurate inventory and liability balances.

12. Intercompany Reconciliation

- Reconcile intercompany transactions to ensure consistency across company codes.

- Use transactions like F.2E (Intercompany Reconciliation) in SAP ECC or leverage SAP S/4HANA’s intercompany reconciliation tools for automated matching.

Final Takeaway

Hence, these are some of the year end activities in SAP FICO that you must be well aware of while meeting your organizational goals. This will boost the chances of your brand value to a greater level.

You can share your views and comments in our comment box. This will help us to know your take on this matter. Try to follow the process step by step, as shown in the article, as this will ease your work to a greater extent in the long run.

- Quick Analysis Tool in Excel: Your One-Click Data Hack - February 18, 2026

- How to Convert Excel to JPG Without Losing Quality - February 18, 2026

- How to Delete Ledger in TallyPrime - February 11, 2026