Audit Trail in TallyPrime: Meaning, Importance, Example, Applicability, Usage

This article is all about the use of Audit Trail in TallyPrime as per directions from MCA, Govt. of India. Starting on April 1, 2023, every business is required to comply with the requirement of an “Audit Trail” or “Edit Log” feature in their accounting software. This feature is made mandatory per notifications from the Ministry of Corporate Affairs (MCA) dated March 24, 2021, and April 1, 2022. Later the audit trail notification was extended to April 1, 2023.

Therefore, it is now necessary to comply with that starting from April 1, 2023,the accounting software that each company uses must abide by the Companies (Accounts) Rules, 2014. The MCA’s purpose in implementing an audit tracking feature in accounting software is to reduce the scope of fraudulent transactions or accounting manipulation in the company’s books of accounts and to increase transparency in financial records.

Table of Contents

Audit Trail Meaning

It is a set of records of every transaction a business or organization makes, along with any alterations or modifications. It is a crucial feature for accounting because it offers a clear and comprehensive history of financial or transactional activities to check the accuracy of financial statements compliant with accounting standards.

Importance of Audit Trail in Accounting

This audit log is crucial in accounting for a number of factors, including the following:

- Verification of financial statements: It will act as a reliable and transparent data of all financial transactions, which can be used to confirm the accuracy of financial statements. This is crucial because external auditors must be able to trust that the fundamental data is accurate when they are reviewing financial statements.

- Compliance with accounting standards: Organizations are required to keep full and accurate records of all financial transactions, which makes an audit trail a crucial part of compliance with accounting standards. It may be challenging or impossible to prove compliance with these standards without an audit record.

- Identification of fraud and errors: This Audit Log can be used to spot fraud as well as other errors or irregularities in financial activities. It makes it simpler to find unusual patterns or discrepancies that might point to fraudulent activity by providing a full record of all transactions.

- Accountability and transparency: By ensuring that all activity is documented and can be traced back to its source, this audit log encourages accountability and transparency in financial activities. By making it harder to cover up unethical behavior, this aids in the prevention or deterrence of deception or unethical behaviour.

In general, an Audit Trail is a crucial part of efficient bookkeeping procedures. It supports the adherence to accounting standards, discourages fraud and other unethical behavior, and serves to guarantee the accuracy and integrity of financial data.

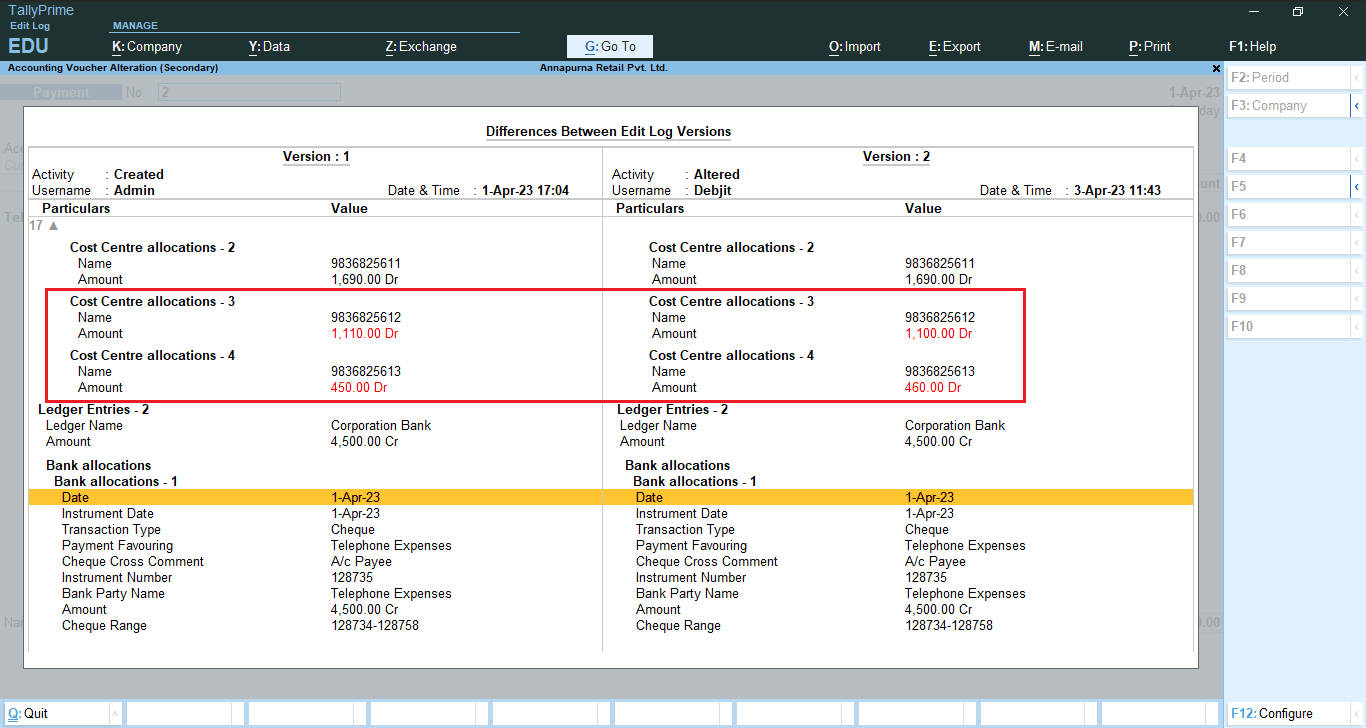

Audit Trail Example

Let’s imagine that on April 1, 2023, a user makes a new sales invoice in TallyPrime with a total amount of INR 15,000 for a client called XYZ Corporation. Later, on March 2, 2023, the user realizes there was a mistake in the invoice amount and adjusts it to INR 16,000.

TallyPrime will log these actions in the audit trail log if the audit trail feature is enabled. The log will demonstrate that the user made the sales invoice on March 1 and modified it with a new total of INR 16,000 on March 2.

The audit trail log will also show the user ID of the altering party, the time and date of the alteration, and the cause for the alteration. (if provided by the user).

This data can be used to track any alterations made to the sales document, as well as who made them and when. It supports the accuracy and security of financial data in the TallyPrime system by aiding in the detection of mistakes or unauthorised changes.

Applicability of Audit Trail in Companies or Businesses

According to the Companies Act 2013, the MCA’s latest amendment, this update will be relevant to the following businesses, including those run by the State and Central Governments and NGOs that receive funding from a variety of stakeholders:

- Companies held by the Indian Government

- State Government Corporations

- All Public and Private Limited Companies

- One Person Companies – (OPCs)

- Not-for-Profit Organizations

- Nidhi Corporations

What is Audit Trail in TallyPrime?

The Audit Trail (Edit Log) feature in TallyPrime enables you to keep track of all the modifications made to your financial data. It keeps track of all the transactions and actions taken within the software, including the user who changed something, when it was changed, what was changed, and who created it.

You get an additional layer of security and transparency from this feature, which also lets you keep track of and manage changes made to your financial data. It aids in the integrity and correctness of your financial records by assisting you in finding any unauthorized changes, mistakes, or discrepancies in your data.

Overall, TallyPrime’s Audit Trail feature aids you in keeping an accurate and transparent record of all transactions.

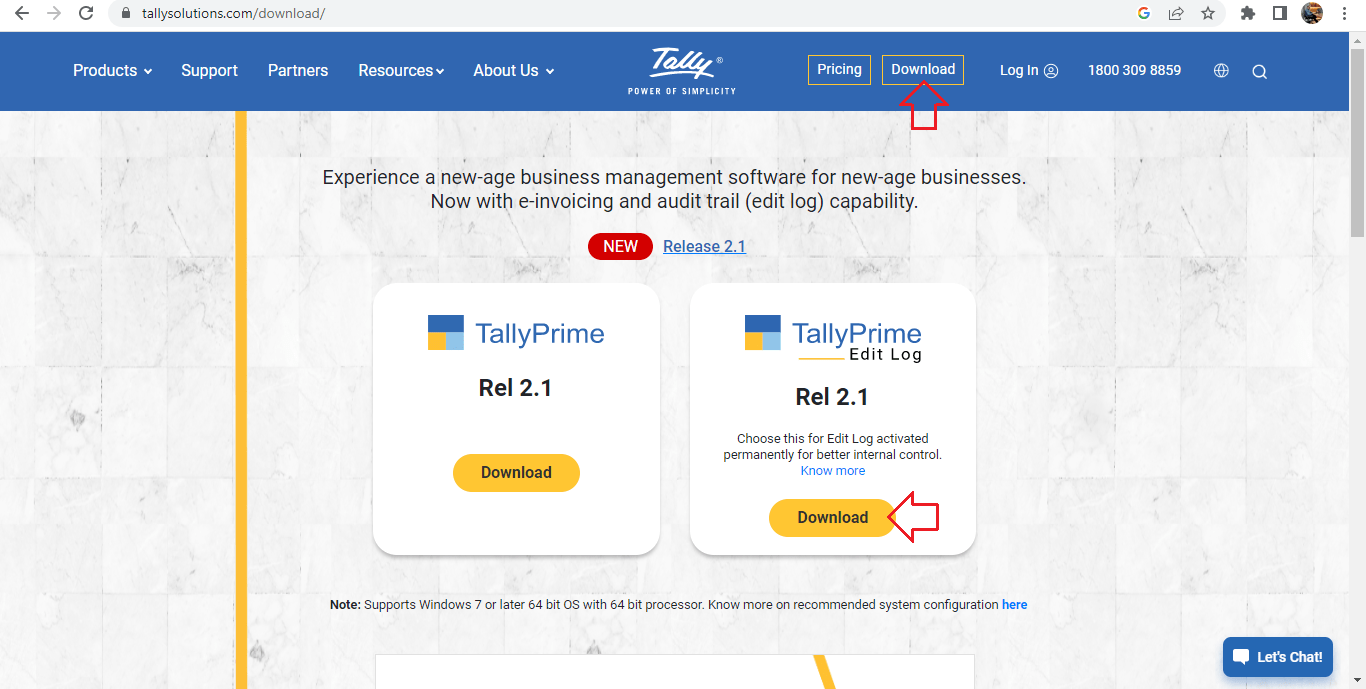

What change is made by TallyPrime software?

In order to implement the audit feature in TallyPrime that the company has released a “Edit Log” product in two different versions, one for companies that must keep and maintain Audit Trail per MCA regulations and the other without such a requirement. Businesses can start keeping their books of accounts for the new fiscal year by selecting a form that best suits their needs.

Businesses with active TSS subscriptions are eligible for a free update to TallyPrime “Edit Log”.

Want growth in your Accounting and Finance Career?Be confident! Learn TallyPrime from Industry Experts |

|

| Browse Classroom Course | Browse Online Course |

| More Learning Options for you: TallyPrijme + GST & TDS | TallyPrime + Business Accounting | TallyPrime + Ms Office | TallyPrime + Payroll |

|

How to enable audit trail in tally prime?

To enable the audit trail in TallyPrime, you need to go to the company’s features menu and select the audit trail option. Once enabled, the system will automatically start tracking all the changes made to the data in real-time.

The step by step method is shown below:

Step 1: Download TallyPrime Edit Log (Rel 2.1) and install it on your system.

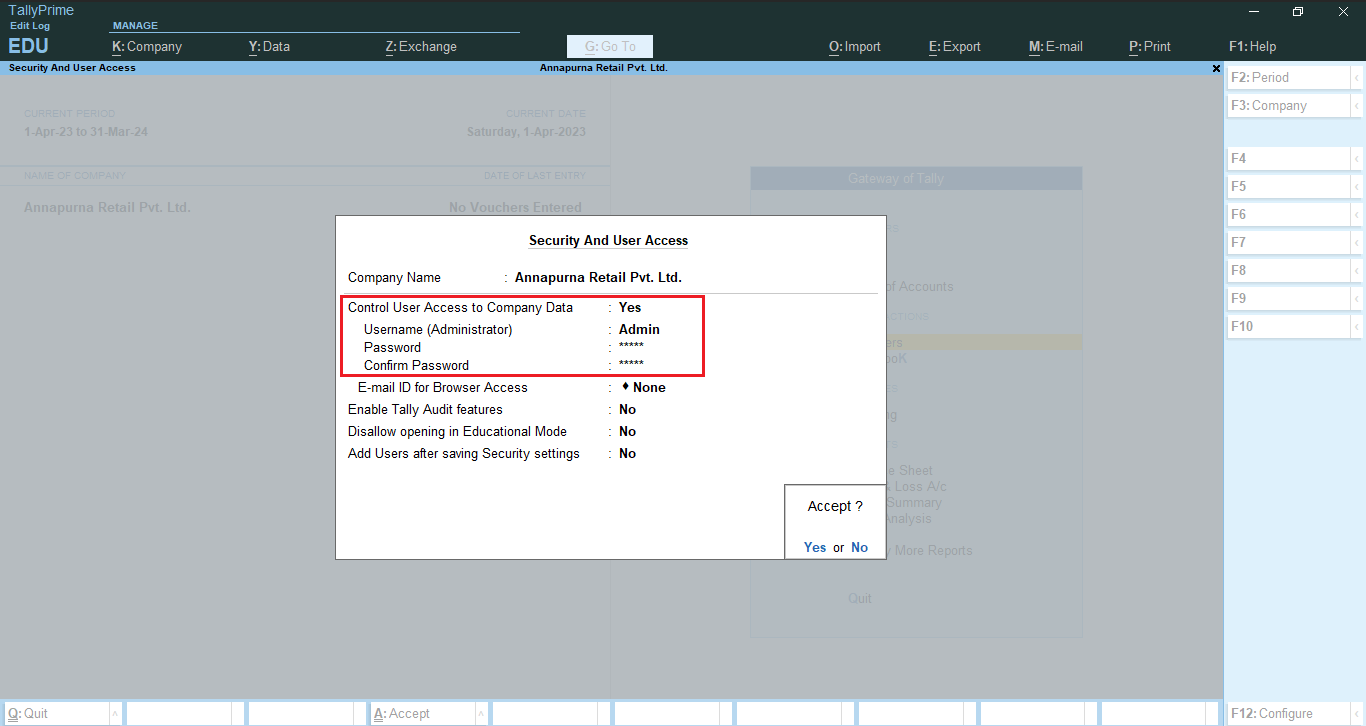

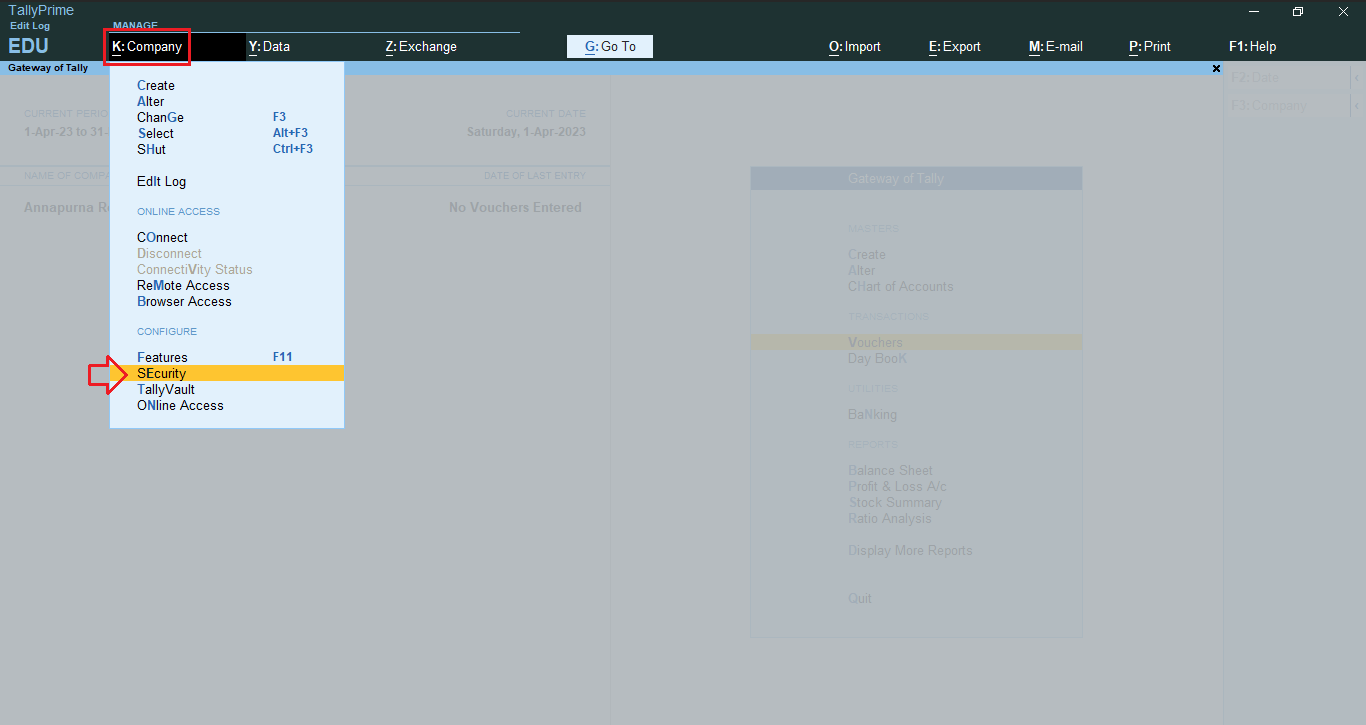

Step 2: Click on ‘Company’ drop down menu and click ‘Security’ (use shortcut key: ALT+K).

Step 3: Set ‘Yes’, the option “Control User Access Company Data”

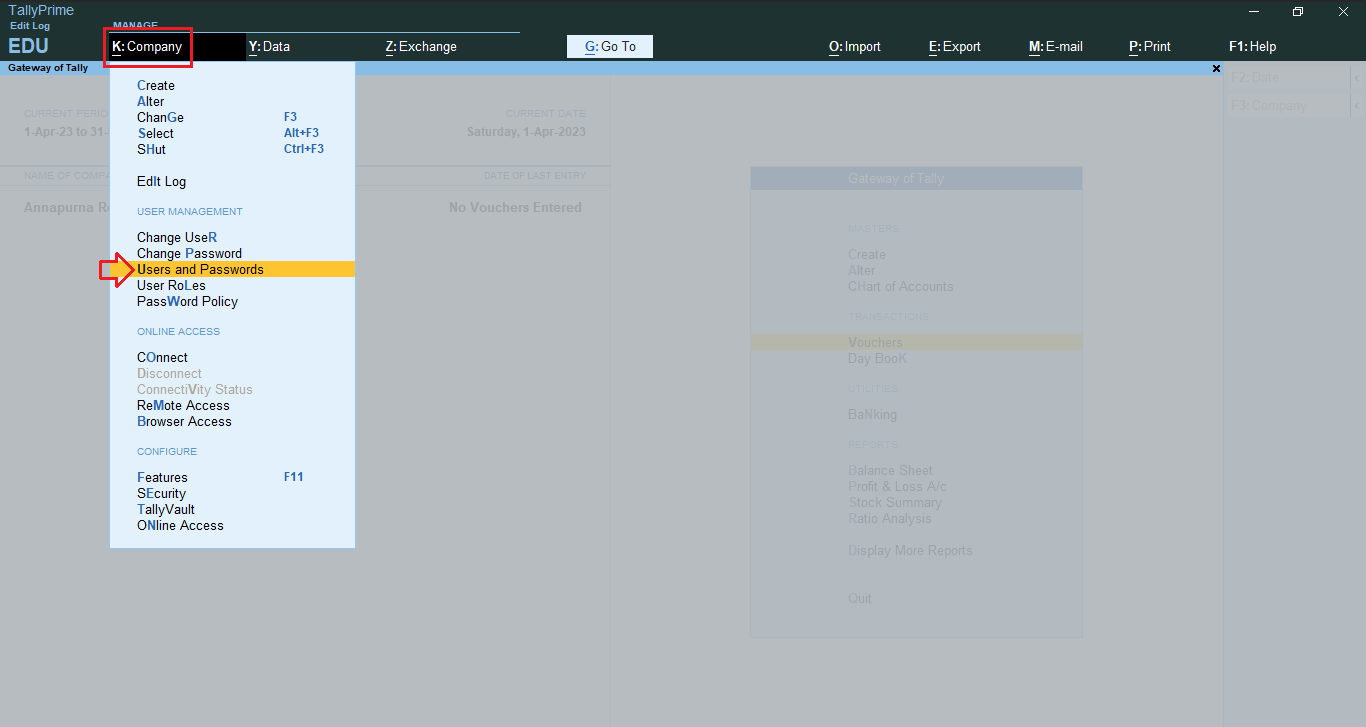

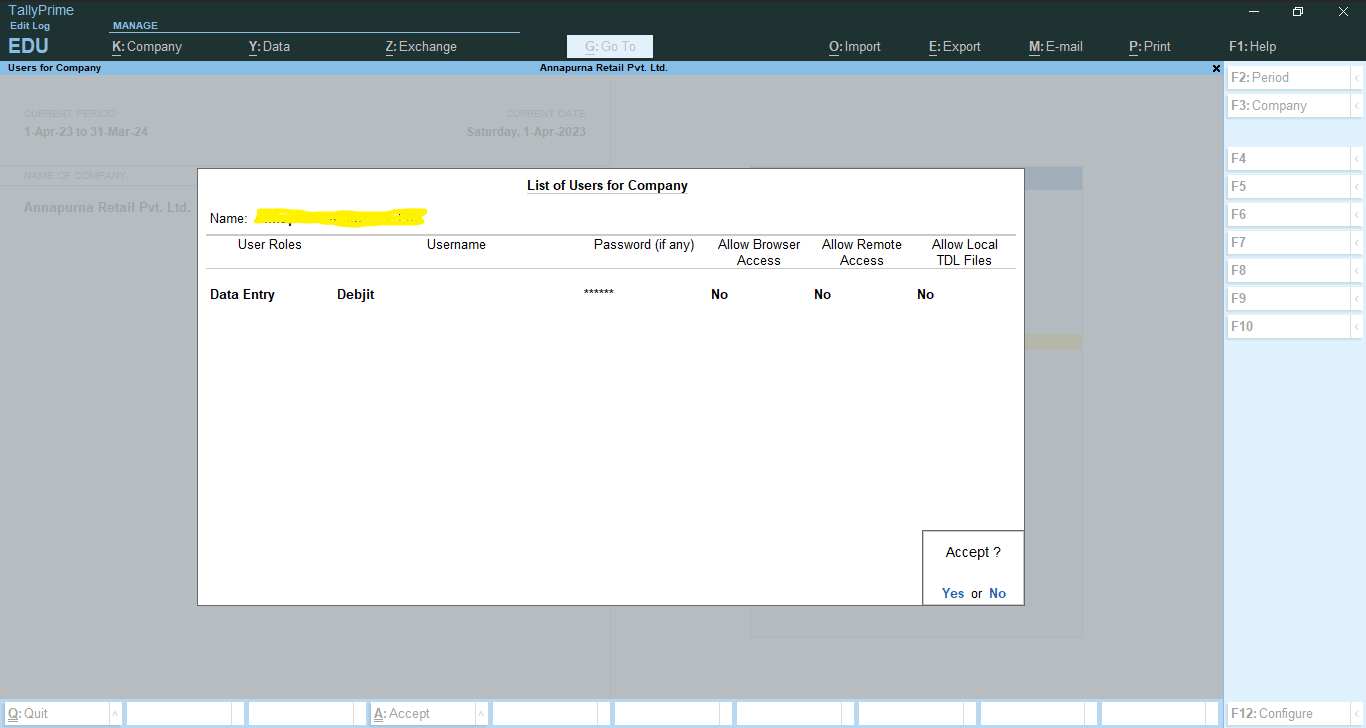

Step 4: Click on ‘Company’ drop down menu again and create a User and Password

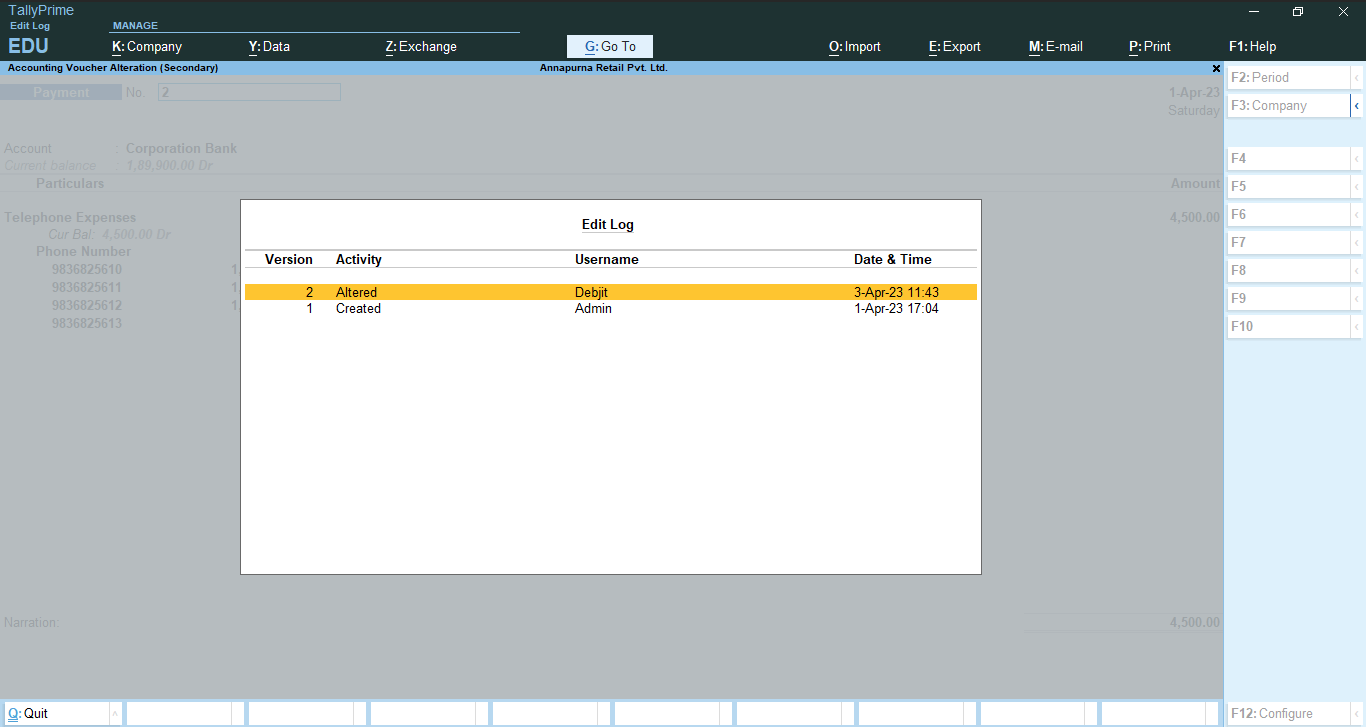

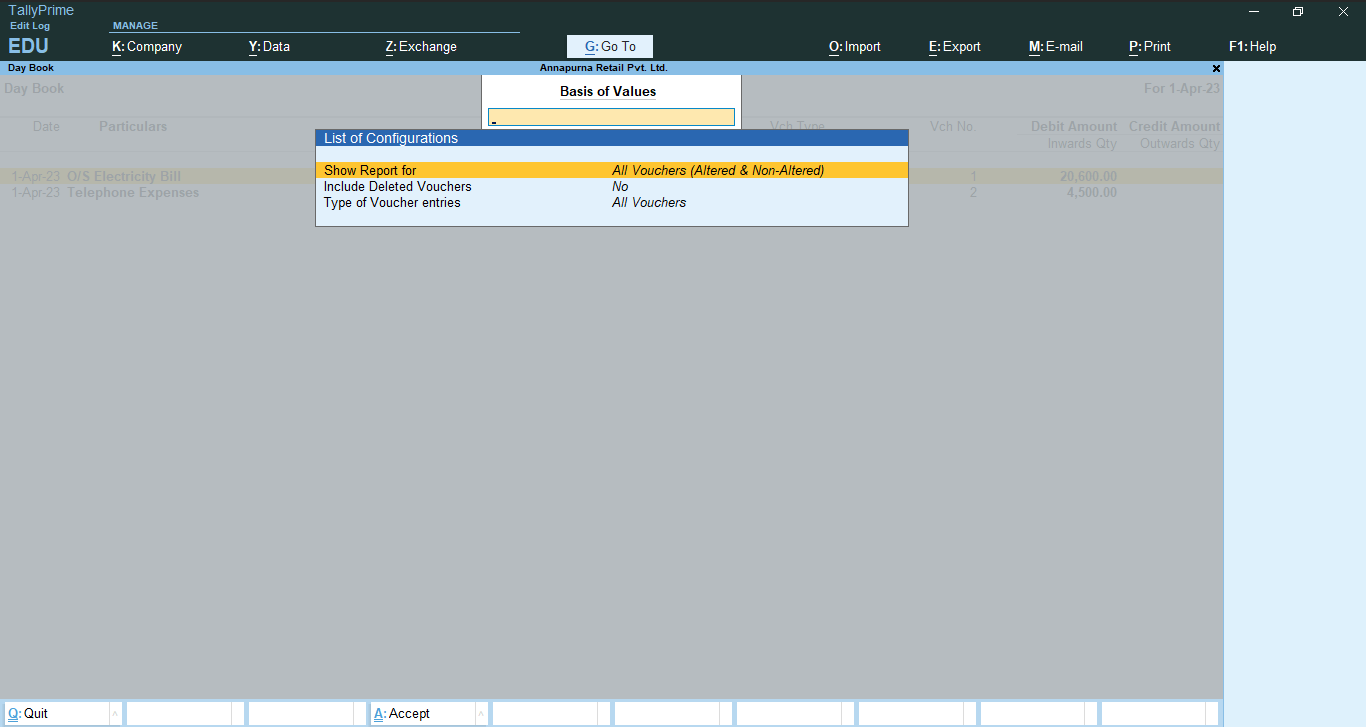

Step 5: Click ‘Day Book’ and select the voucher (use shortcut key: ALT + Q)

Then you can see the “Edit Log” report

For more information you can click on Day Book drop down menu and use shortcut key: CTRL + B. Following window will be open.

Note:

• You may select the option from the list of configurations as per your requirements.

• Similarly, you can use edit log in Master (Ledgers, Groups, Stock Items).

• You can also see edit log from company level also (use short key ALT + K) then click “Edit Log”

Visit www.icacourse.in to find the list of online accounting and taxation courses curated by top industry experts.