BRS In Accounting: Format, Method, Purpose & Benefit

BRS in Accounting is essential for identifying all the errors in your financial system that can affect your financial position and tax. It identifies and resolves discrepancies, such as unrecorded transactions, timing differences, or errors, ensuring the cash balance is accurate.

The process involves matching the company’s cash account balance with the bank’s records, accounting for outstanding checks, deposits in transit, bank fees, or interest earned. BRS is essential for detecting fraud, preventing overdrafts, and maintaining reliable financial reporting.

It enhances internal controls, ensuring transparency and compliance with accounting standards.By regularly preparing a BRS, businesses can verify the integrity of their financial transactions, address discrepancies promptly, and maintain trust with stakeholders.

Table of Contents

- What Is BRS In Accounting

- Purpose Of The Bank Reconciliation Statemen

- How Often You Require To Produce The Bank Reconciliation Statement?

- Reasons For Preparing Bank Reconciliation Statement

- How To Prepare BRS In Accounting?

- Basic Rules Of BRS In Accounting

- Bank Reconciliation Statement Format

- How Tally Can Help You To Prepare A Bank Reconciliation Statement?

- Tricks To Solve BRS In Accounts

- Frequently Asked Questions(FAQ)

- Final Takeaway

What Is BRS In Accounting?

BRS in accounting is a document that compares a company’s internal cash records (per its general ledger) with the bank statement to ensure consistency and accuracy.

It identifies discrepancies caused by timing differences, errors, or unrecorded transactions, such as outstanding checks, deposits in transit, bank fees, or interest earned. The purpose of BRS is to verify the cash balance, detect fraud, correct errors, and ensure reliable financial reporting.

The process involves adjusting the bank statement balance or the company’s cash book balance to account for these differences.

Regular preparation of a BRS strengthens internal controls, ensures compliance with accounting standards, and supports accurate financial decision-making. It is a vital practice for businesses of all sizes to maintain transparency and trust in their financial operations.

Purpose Of The Bank Reconciliation Statement

There are various crucial purposes of a Bank reconciliation statement that you need to take care of. Some of the core crucial purpose of BRS are as follows:-

1. Ensuring Accuracy Of Financial Records

The foremost purpose of a BRS is to confirm the accuracy of a company’s cash balance. Discrepancies often arise between the cash balance recorded in the company’s general ledger (cash book) and the balance shown in the bank statement. These differences can stem from timing issues, errors, or unrecorded transactions.

For instance, checks issuance but not yet accepted by the bank (outstanding checks) or deposits made but not yet reflected in the bank statement (deposits in transit) create temporary mismatches. BRS in accounting forms the backbone of any business in 2025.

By preparing a BRS, businesses can reconcile these differences, ensuring that the cash balance reported in their financial statements is accurate. This accuracy is crucial for preparing reliable financial reports, such as balance sheets and cash flow statements, which stakeholders rely on for decision-making.

2. Identifying & Resolving Discrepancies

Another critical purpose of the BRS is to identify and resolve discrepancies between the company’s records and the bank’s records. These discrepancies can arise from various sources, including:

- Timing Differences: Transactions recorded in the company’s books may not yet appear in the bank statement, or vice versa. For example, a check issued to a supplier may take several days to clear, or a deposit made late in the day may not be reflected in the bank statement until the next business day.

- Bank Charges and Fees: Banks often deduct service fees, transaction charges, or penalties that the company may not have recorded in its cash book. Similarly, interest earned on a checking account may not be immediately recorded.

- Errors: Mistakes in recording transactions, either by the company or the bank, can lead to differences. For instance, a transposition error (e.g., recording Rs 1,234 as Rs 1,324) or an incorrect transaction amount can create a mismatch.

- Unrecorded Transactions: Some transactions, such as direct debits, standing orders, or bank-initiated adjustments, may not be recorded in the company’s books until the bank statement is received.

3. Detecting & Preventing Fraud

The BRS plays a vital role in detecting and preventing fraudulent activities. Fraud, such as unauthorized withdrawals, forged checks, or misappropriation of funds, can go unnoticed without regular reconciliation. By comparing the company’s records with the bank statement, a BRS can uncover suspicious transactions that were not authorized or recorded by the company.

For example, if an employee issues a check to a fictitious vendor and attempts to conceal it, the BRS process will reveal the discrepancy when the unauthorized transaction appears in the bank statement but not in the company’s cash book.

4. Strengthening Internal Controls

A BRS is an essential component of a company’s internal control system. Internal controls are policies and procedures designed to protect assets, ensure accurate financial reporting, and promote compliance with laws and regulations. BRS in accounting is essential for removing errors in the process.

By regularly preparing a BRS, businesses demonstrate a commitment to monitoring and verifying their financial transactions, which strengthens overall financial governance.

The reconciliation process requires segregation of duties, a key internal control principle. For example, the person preparing the BRS should ideally be different from the one recording transactions or handling cash.

This separation reduces the risk of errors or fraud going undetected. Furthermore, the BRS process encourages accountability among employees, as discrepancies must be investigated and resolved. This scrutiny ensures that financial processes are transparent and that any irregularities are promptly addressed.

5. Preventing Overdrafts & Financial Mismanagement

A BRS helps businesses avoid overdrafts and financial mismanagement by ensuring they have an accurate understanding of their available cash. Overdrafts occur when a company spends more than the available balance in its bank account, leading to costly fees and potential damage to its financial reputation.

Without reconciliation, a company may rely on an inaccurate cash balance, inadvertently withdrawing funds that are not available due to unrecorded bank charges or pending transactions.

By identifying outstanding checks, unrecorded fees, or other adjustments, the BRS provides a clear picture of the actual cash available for use. This information allows businesses to manage their cash flow effectively, avoid overdraft penalties, and make informed decisions about expenditures, investments, or loan repayments. For small businesses with limited cash reserves, this purpose of the BRS is particularly critical, as even a single overdraft can have significant financial consequences.

6. Ensuring Compliance With Accounting Standards

Compliance with accounting standards and regulations is a key responsibility for businesses, particularly those subject to audits or regulatory oversight. A BRS supports compliance by ensuring that cash balances are accurately reported in financial statements.

Accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), require companies to present reliable and verifiable financial information. A BRS helps meet these requirements by validating the cash balance and documenting adjustments made during the reconciliation process.

7. Supporting Financial Decision Making

Accurate cash balances are essential for effective financial decision-making. Management relies on financial reports to make strategic decisions, such as budgeting, forecasting, investing, or expanding operations. A BRS ensures that these reports reflect the true cash position, enabling informed decisions.

For example, a company planning to invest in new equipment needs to know its exact cash availability to avoid overextending its resources. Similarly, creditors and investors use cash balance information to assess the company’s liquidity and financial health. By providing a reliable cash balance, the BRS supports these critical decisions.

How Often You Require To Produce The Bank Reconciliation Statement?

The time for producing a Bank Reconciliation Statement (BRS) depends on a company’s size, transaction volume, and financial management needs. Generally, businesses should prepare a BRS monthly, as bank statements are typically issued on a monthly basis. This ensures timely identification of discrepancies, errors, or fraud, and maintains accurate financial records.

For businesses with high transaction volumes, such as retail or large corporations, a weekly or even daily BRS may be necessary to closely monitor cash flow and prevent issues like overdrafts. Smaller businesses with fewer transactions might opt for a monthly or quarterly reconciliation, though monthly is still recommended to align with financial reporting cycles.

Regular reconciliation—ideally monthly—ensures compliance, supports accurate budgeting, and strengthens internal controls. However, the exact frequency should be tailored to the business’s operational needs and the complexity of its cash transactions.

Reasons For Preparing Bank Reconciliation Statement

The Bank Reconciliation Statement (BRS) is a vital accounting tool, and preparing it serves several critical purposes. Below are the key reasons for preparing a BRS, each contributing to financial accuracy, control, and transparency:

1. Ensure Accuracy & Cash Balances

The BRS verifies that the cash balance in the company’s books matches the bank statement. It reconciles differences caused by timing issues (e.g., outstanding checks or deposits in transit), ensuring accurate financial records for reliable reporting and decision-making. BRS in accounting can make the process of cash accuracy and cash balances work simultaneously.

2. Identifies The Correct Discripencies

Discrepancies between the cash book and bank statement, such as unrecorded bank fees, interest, or errors in recording transactions, are identified and resolved. This ensures both records align and reflect the true cash position. BRS in accounting can help you to reduce the discrepancies in accounting records effectively.

3. Detect & Prevent Frauds

By comparing records, a BRS can uncover unauthorized transactions, such as forged checks or unrecorded withdrawals, helping to detect and deter fraudulent activities.

4. Strengthens Internal Controls

Regular reconciliation reinforces financial oversight by requiring scrutiny of transactions, promoting accountability, and ensuring segregation of duties, which reduces the risk of errors or fraud.

5. Prevents Overdrafts & Financial Mismanagement

A BRS provides an accurate view of available cash, helping businesses avoid overdrafts, manage cash flow effectively, and make informed financial decisions. BRS in accounting can help you to prevent overdrafts and financial mismanagement.

6. Ensure Compliance With Accounting Standards

Preparing a BRS ensures compliance with standards like GAAP or IFRS by validating cash balances, supporting accurate financial statements, and providing audit-ready documentation. BRS in accounting can assist you in reaching your business goals with complete ease.

Few insightful articles on Accounts to improve your knowledge:

How To Prepare BRS In Accounting?

Preparing a Bank Reconciliation Statement (BRS) in accounting involves a systematic process to align a company’s cash book balance with the bank statement balance, identifying and resolving discrepancies. Below is a step-by-step guide to preparing a BRS, designed to be clear and concise for practical application:

1. Gather Necessary Documents

- Obtain the company’s cash book (or general ledger cash account) for the period.

- Collect the bank statement for the same period, typically monthly.

- Ensure both records cover the same timeframe to facilitate accurate comparison.

2. Compare Opening Balances

- Verify that the opening cash balance in the cash book matches the closing balance from the previous period’s reconciled bank statement.

- If discrepancies exist, investigate and resolve any errors from prior reconciliations before proceeding.

3. Compare Transactions

- Match each transaction in the cash book with the corresponding entry in the bank statement.

- Check for:

- Deposits: Ensure all deposits recorded in the cash book appear in the bank statement.

- Withdrawals/Payments: Confirm all checks, withdrawals, or payments in the cash book are reflected in the bank statement.

- Mark matched transactions to avoid confusion.

4. Identify Timing Differences

Note transactions recorded in one record but not the other due to timing:

- Outstanding Checks: Checks issuance by the company but not yet presented to or got the clearance from the bank. These appear in cash book but not in the bank statement.

- Deposits in Transit: Deposits that are recorded in cashbook but not credited by the bank. These appear in cash book but not in the bank statement.

5. Identify Unrecorded Transactions

Look for items in the bank statement not recorded in the cash book, such as:

- Bank Fees: Service charges, transaction fees, or penalties deducted by the bank.

- Interest Earned: Interest credited by the bank on the account balance.

- Direct Debits/Standing Orders: Automatic payments or collections initiated by the bank.

- Bank Errors: Incorrect charges or credits made by the bank.

Record these in the cash book to update the company’s records.

6. Adjust The Cashbook

Update the cash book with unrecorded transactions found in the bank statement:

- Add interest earned or other credits to the cash book.

- Deduct bank fees, service charges, or direct debits from the cash book.

Calculate the adjusted cash book balance after these entries.

7. Prepare The BRS

Start with the bank statement balance (as reported by the bank).

Make adjustments to account for timing differences:

- Add: Deposits in transit (amounts not yet credited by the bank).

- Deduct: Outstanding checks (amounts that are on hold by the bank).

Alternatively, start with the cash book balance and adjust for:

- Bank fees, interest, or other unrecorded transactions already updated in the cash book.

- Timing differences (e.g., add back outstanding checks or deduct deposits in transit, depending on the format).

The goal is to arrive at a reconciled balance where the adjusted bank balance equals the adjusted cash book balance.

Basic Rules Of BRS In Accounting

The Bank Reconciliation Statement (BRS) in accounting follows a set of basic rules to ensure accurate reconciliation between a company’s cash book and the bank statement. These rules guide the identification, adjustment, and resolution of discrepancies. Below are the fundamental rules for preparing a BRS:

1. Compare Both Records

- Always start by comparing the company’s cash book (general ledger) with the bank statement for the same period.

- Match transactions to identify differences due to timing, errors, or unrecorded items.

2. Adjust For Timing Difference

- Add to the bank statement balance: Deposits in transit.

- Deduct from the bank statement balance: Outstanding checks (checks issued but not got the clearance from the bank).

- These adjustments account for transactions that are recorded in one record but not the other due to processing delays.

3. Update Cashbook For Unrecorded Stock

- Add to the cash book: Interest earned or other credits (e.g., direct deposits) appearing in the bank statement but not recorded in the cash book.

- Deduct from the cash book: Bank fees, service charges, direct debits, or penalties listed in the bank statement but not yet recorded.

- Correct any errors found in the cash book (e.g., incorrect amounts or missed entries) with journal entries.

4. Identify & Correct Errors

Check for errors in both the cash book and bank statement, such as:

- Transposition errors (e.g., recording Rs 123 as Rs 132).

- Omitted transactions or incorrect amounts.

Correct cash book errors through journal entries; report bank errors to the bank for resolution.

5. Ensure Balances Match

- After adjustments, the adjusted cash book balance should equal the adjusted bank statement balance.

- If they don’t match, recheck for missed transactions, calculation errors, or unresolved discrepancies.

6. Start With Accurate Opening Balances

- Ensure the opening cash book balance aligns with the closing balance from the previous period’s reconciled bank statement.

- Resolve any prior discrepancies before preparing the current BRS.

7. Document The Reconciliation

Prepare a formal BRS showing:

- Bank statement balance.

- Adjustments (e.g., deposits in transit, outstanding checks, bank fees).

- Adjusted balances for both the bank statement and cash book.

Include notes on any unresolved issues for follow-up or audit purposes.

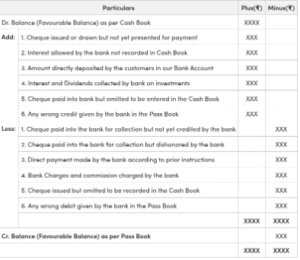

Bank Reconciliation Statement Format

How Tally Can Help You To Prepare A Bank Reconciliation Statement?

Tally (including Tally.ERP 9 and TallyPrime) is a powerful accounting software that simplifies the preparation of a Bank Reconciliation Statement (BRS) by automating much of the manual work, reducing errors, and ensuring your books align with bank statements.

1. Activate Auto BRS

- Go to Gateway of Tally > Accounts Info > Ledgers > Alter/Create your bank ledger.

- Set Set/Alter Auto BRS Configuration to Yes.

- Specify bank details (e.g., branch, account number) and accept (Ctrl+A).

2. Import Bank Statement

- Download your bank statement in Excel/CSV.

- Go to Gateway of Tally > Import > Bank Statement.

- Select the bank ledger, choose the file, and map columns (e.g., date, amount, reference). Tally auto-matches and reconciles eligible transactions.

3. Access Bank Reconciliation

- Navigate to Gateway of Tally > Banking > Bank Reconciliation.

- Select the bank ledger and set the From Date (e.g., start of the period) for reconciliation.

4. Reconciliation Transactions

- Tally displays Balance as per Books vs. Balance as per Bank.

- For unmatched items:

- Enter Bank Date (clearing date from statement) in the relevant column for each voucher (press Enter on the transaction).

- Use F5: Reconcile to mark matches.

- For timing differences (e.g., outstanding checks), leave Bank Date blank or future-dated.

- Add unrecorded items (e.g., bank fees) by creating new vouchers directly from the screen.

5. Handle Discrepancies

- Review Unreconciled Transactions section.

- Convert pending entries to Optional Vouchers (Alt+O) if not yet cleared.

- Adjust for errors: Alter vouchers (Ctrl+Enter) and confirm changes (Tally warns if reconciled items are modified).

6. Generate And Review BRS

- The screen auto-updates the Reconciled Balance.

- Use F12: Configure to filter (e.g., show all till date) or print the BRS.

- Verify: Adjusted book balance should match adjusted bank balance.

Tricks To Solve BRS In Accounts

Preparing a Bank Reconciliation Statement (BRS) can be streamlined with practical tricks to make the process faster, more accurate, and less error-prone. Below are effective tips and tricks to solve BRS efficiently in accounting, whether done manually or with software like Tally:

1. Start With A Clear Framework

Understand the Goal: The aim is to make the adjusted cash book balance equal the adjusted bank statement balance. Always keep this in mind to stay focused.

Use a Standard Format: Create a template with sections for:

- Bank statement balance

- Adjustments (deposits in transit, outstanding checks)

- Cash book balance

- Unrecorded items (fees, interest)

This structure prevents confusion and ensures all elements are covered.

2. Work From Bank Statement Balance

Start with the Bank Balance: Begin with the bank statement balance and adjust for timing differences (add deposits in transit, deduct outstanding checks). This approach is often simpler than starting with the cash book, as bank statements are less prone to company-side errors.

Trick: Label the bank balance as the “starting point” and list adjustments systematically to avoid missing items.

3. Tick & Match Transactions

Use a Checkmark System: As you compare the cash book and bank statement, tick off matched transactions in both records. This visually confirms what’s reconciled and highlights unmatched items.

Trick: Use different colored pens (e.g., blue for cash book, red for bank statement) to track matches and avoid double-counting.

4. Group Timing Differences

Categorize Timing Items: Separate deposits in transit and outstanding checks into distinct lists. This makes it easier to apply adjustments.

Trick: Keep a running list of outstanding checks from previous reconciliations. Update it monthly to quickly identify which checks remain uncleared.

5. Handle Unrecorded Items First

Update the Cash Book Promptly: Before reconciling, adjust the cash book for unrecorded items like bank fees, interest earned, or direct debits found in the bank statement.

Trick: Create a checklist of common unrecorded items (e.g., service charges, auto-debits) to scan the bank statement quickly. This ensures the cash book is up-to-date before adjustments.

6. Use The Add Deduct Rule

Memorize Adjustment Rules:

- Bank Statement Adjustments:

- Add: Deposits in transit (not yet credited by the bank).

- Deduct: Outstanding checks.

- Cash Book Adjustments:

- Add: Interest earned or direct deposits.

- Deduct: Bank fees, penalties, or direct debits.

Trick: Use a mnemonic like “DIO” (Deposits In, Outstanding Out) for bank adjustments and “IFE” (Interest In, Fees Out) for cash book adjustments to recall rules quickly.

7. Leverage Accounting Software

Use Tally or Similar Tools: Software like TallyPrime automates matching by importing bank statements and flagging discrepancies. It reduces manual work and errors.

Trick: In Tally, enable Auto BRS, import statements in CSV/Excel, and use F5: Reconcile to auto-match transactions. Manually verify only unmatched items to save time.

8. Breakdown Large Transaction

Segment High-Volume Accounts: For businesses with many transactions, reconcile in smaller batches (e.g., by week or transaction type like deposits vs. withdrawals).

Trick: Sort transactions by amount or date in both records to spot large discrepancies quickly, as these often cause significant mismatches.

9. Double Check With A Calculator

Verify Calculations: Even small math errors can throw off the reconciliation. Use a calculator or spreadsheet to confirm additions and subtractions.

Trick: Cross-check the adjusted balances by working backward (e.g., start from the reconciled balance and reverse adjustments to ensure accuracy).

10. Track Recurring Issues

Maintain a Discrepancy Log: Note common issues (e.g., frequent bank fees, delayed deposits) and their resolutions in a log for future reference.

Trick: Review the log before starting the BRS to anticipate recurring items, reducing investigation time.

11. Reconcile Regularly

Stick to a Schedule: Perform BRS monthly (or weekly for high-transaction businesses) to keep discrepancies manageable.

Trick: Set a fixed date (e.g., 5th of each month) after receiving the bank statement to make reconciliation a routine, minimizing backlog.

12. Segregate Duties

Assign Different Roles: Ensure the person handling cash transactions isn’t the one reconciling to prevent fraud or oversight.

Trick: Use Tally’s user access controls to assign reconciliation tasks to a separate team member, enhancing internal controls.

13. Use Visual Aids For Clarity

Create a Reconciliation Table: In a spreadsheet or on paper, list bank balance, cash book balance, and adjustments side by side.

Trick: Highlight timing differences (e.g., yellow for outstanding checks, green for deposits in transit) to visually track adjustments.

14. Resolve Discripencies Immediately

Act on Mismatches: If the adjusted balances don’t match, investigate immediately. Common culprits include missed transactions, transposition errors (e.g., $123 vs. $132), or bank errors.

Trick: Use the difference amount as a clue. For example, a $100 discrepancy might indicate a missed $100 bank fee or a transposed amount.

15. Keep Records Organized

Archive Documents: Store bank statements, cash book records, and BRS reports in an organized manner for audits or future reference.

Trick: In Tally, export BRS reports as PDFs and save them with dates (e.g., “BRS_Sep2025.pdf”) for easy retrieval.

Frequently Asked Questions(FAQ)

1. What is a Bank Reconciliation Statement (BRS)?

Answer: A BRS is an accounting document that compares a company’s cash book balance with its bank statement balance to identify and resolve discrepancies. It ensures the accuracy of cash records by accounting for timing differences (e.g., outstanding checks, deposits in transit), unrecorded items (e.g., bank fees, interest), and errors, supporting reliable financial reporting.

2. Why is a BRS necessary?

Answer: A BRS is necessary to verify the accuracy of cash balances, detect errors or fraud, prevent overdrafts, and ensure compliance with accounting standards. It strengthens internal controls, supports informed financial decisions, and fosters transparency with stakeholders by aligning the company’s records with the bank’s.

3. How often should a BRS be prepared?

Answer: A BRS is typically prepared monthly to align with bank statement cycles. Businesses with high transaction volumes may reconcile weekly or daily to monitor cash flow closely. Regular reconciliation ensures timely detection of discrepancies and maintains accurate financial records.

4. What are common reasons for discrepancies in a BRS?

Answer: Discrepancies arise from timing differences (e.g., outstanding checks, deposits in transit), unrecorded transactions (e.g., bank fees, interest earned, direct debits), or errors (e.g., transposition mistakes, incorrect entries). A BRS identifies and adjusts these to align the cash book and bank statement balances.

5. Can accounting software like Tally simplify BRS preparation?

Answer: Yes, software like TallyPrime automates BRS by importing bank statements, matching transactions, and flagging discrepancies. It updates the cash book for unrecorded items, generates reconciliation reports, and reduces manual errors, saving time and ensuring accuracy.

Final Takeaway

Hence, these are some crucial facts about BRS in accounting that you need to take care off. Proper maintenance of BRS can assist you at the time of reconciliation of the final statement. So, if you want to maintain error free accounting records then proper maintenance of BRS is important.

You can share your feedback with us in the comment box. This will help us to know your take on this matter. Your response is important to us so feel free to share your comments.

- 3 Smart Ways to Speed Up Data Entry and Processing in Excel - January 27, 2026

- How to Convert Images Containing Tables into Editable Excel - January 27, 2026

- One Nation, One ID: Understanding the Academic Bank of Credits - January 22, 2026