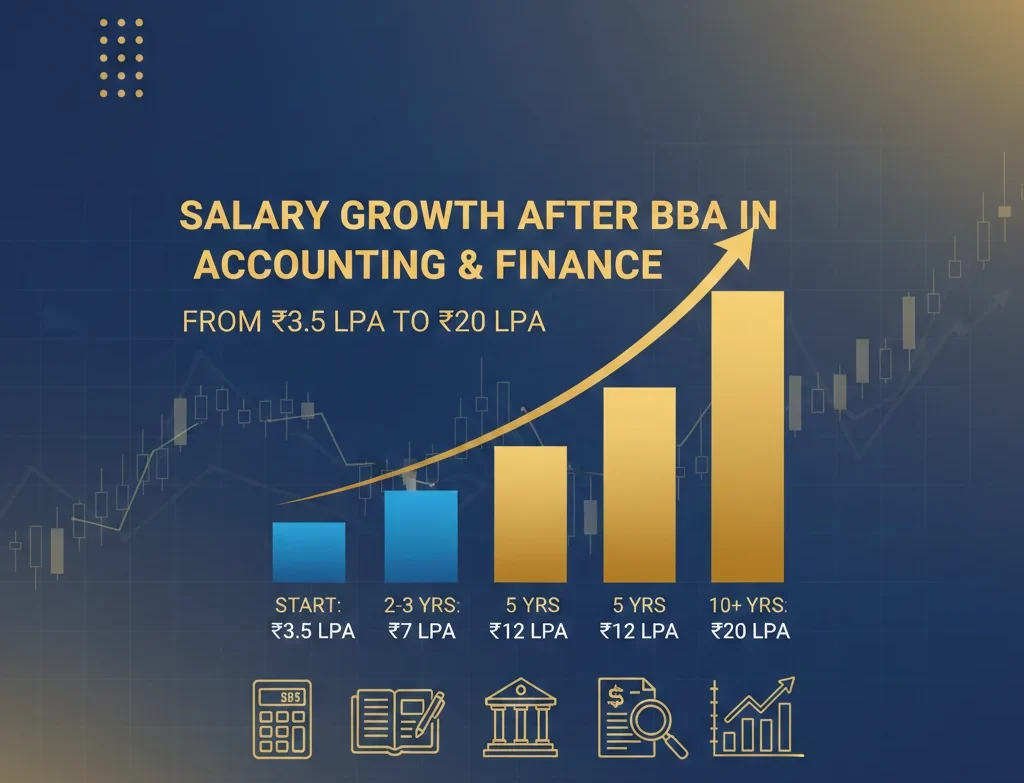

What Will Be the Salary After Doing BBA in Accounting and Finance?

If you enjoy numbers and business strategy, a BBA in Accounting and Finance is a fantastic choice. But let’s get to the most important question: what is the BBA in accounting and finance salary you can expect? Whether you are a student planning your future or a professional looking to upskill, understanding your earning potential is key. The good news is that the financial sector remains one of the highest-paying industries in India.

Average Salary After BBA in Accounting and Finance

In 2026, the starting salary for a fresh graduate typically ranges between ₹3.5 Lakh to ₹6 Lakh per annum (LPA). However, this is just the beginning. Candidates with specialized skills or those from top-tier institutes often see offers touching ₹8 LPA right at the start.

Salary Breakdown by Job Role

Your specific role significantly impacts your paycheck. Finance is a broad field with various entry points.

| Job Role | Average Starting Salary (LPA) | Mid-Level Salary (3-5 Years) |

|---|---|---|

| Financial Analyst | ₹4.5 - ₹7.0 Lakh | ₹9 - ₹12 Lakh |

| Tax Consultant | ₹3.5 - ₹5.5 Lakh | ₹7 - ₹10 Lakh |

| Investment Banker | ₹6.0 - ₹10.0 Lakh | ₹15 - ₹20 Lakh |

| Internal Auditor | ₹4.0 - ₹6.5 Lakh | ₹8 - ₹11 Lakh |

| Accountant | ₹3.0 - ₹4.5 Lakh | ₹5 - ₹7 Lakh |

Get a BBA Degree with Paid Internship1-year paid internship + 10 Simulation Software + 4 Certifications to land high-paying roles |

|

| BBA in Accounting and Finance |

Factors Affecting Your Earning Potential

Several factors determine your final package. It is not just about the degree; it is about how you present your expertise.

Location and City

Metropolitan cities usually offer higher salaries to compensate for the cost of living.

- Mumbai & Bengaluru: These are financial hubs. You can expect 15-20% higher pay here.

- Delhi & Pune: Competitive salaries with a focus on corporate accounting.

- Tier 2 Cities: Lower starting pay, but also a much lower cost of living.

BBA in Finance and Accounting by ICA Edu Skills and Shobhit University

Choosing the right program makes a huge difference. For instance, the BBA in Finance and Accounting by ICA Edu Skills and Shobhit University is designed for industry readiness. This program stands out because it includes a 1-year paid internship. By the time you graduate, you already have professional experience. This practical edge often leads to a higher starting bba in accounting and finance salary compared to traditional theoretical courses.

How to Increase Your Salary Quickly

If you want to reach the 8-digit club faster, consider these steps:

- Get Certified: Pursue global certifications like CFA, ACCA, or US CMA.

- Master Tools: Learn software like TallyPrime, SAP FICO, and Advanced Excel.

- Soft Skills: Communication and negotiation are vital for high-level finance roles.

Conclusion

The career outlook for finance graduates is incredibly bright. While your initial BBA in accounting and finance salary might start at a modest level, the growth curve is steep. If you prefer flexibility, an online BBA or a work-integrated program can give you the head start you need. Focus on gaining practical skills, and the numbers on your paycheck will surely follow.

Frequently Asked Questions

1. Is BBA in Accounting and Finance a high-paying degree?

Yes, it is one of the most lucrative undergraduate degrees. The finance sector consistently offers higher entry-level packages compared to general management roles.

2. Can I get a job in a bank after this degree?

Absolutely. Graduates can work as relationship managers, loan officers, or credit analysts in both private and public sector banks.

3. Does an internship increase my starting salary?

Yes, candidates with internship experience often command a 10% to 20% higher starting salary because they require less on-the-job training.