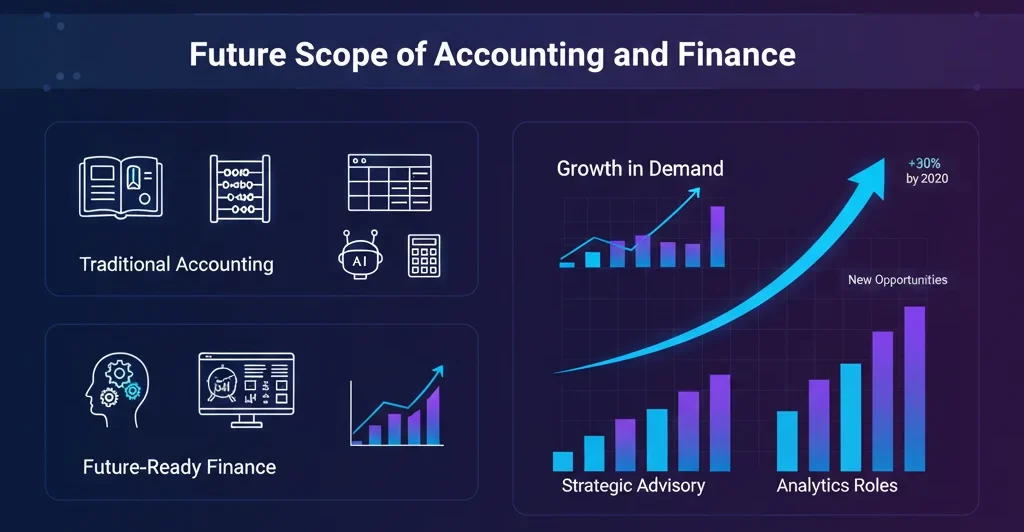

Future Scope of Accounting and Finance

The world of money is changing fast. If you are looking at a career in this field, you might wonder about the future scope of accounting and finance. Is it all just spreadsheets? Not anymore. Today, technology and strategy are taking the lead.

The Shifting Landscape of Finance

In the past, accounting was mostly about record-keeping. However, things look very different as we move toward 2030. Automation is now handling the heavy lifting of data entry. This shift allows professionals to become strategic advisors. You won't just report numbers; you will explain what they mean for the business.

Why the Future is Bright

The demand for financial experts is actually growing. Businesses need people who can navigate complex global markets. They need experts to manage risks and use data for growth.

| Feature | Traditional Accounting | Future-Ready Finance |

|---|---|---|

| Primary Task | Bookkeeping & Compliance | Strategic Advisory & Analytics |

| Core Tool | Manual Ledgers/Basic Excel | AI, SAP FICO, & Power BI |

| Focus | Historic Data | Predictive Forecasting |

| Skill Requirement | Arithmetical Accuracy | Data Literacy & AI Fluency |

Get a BBA Degree with Paid Intership1-year paid internship + 10 Simulation Software + 4 Certifications to land high-paying roles |

|

| BBA in Accounting and Finance |

The Role of Technology and AI

Artificial Intelligence (AI) is not a threat; it is a partner. It helps identify fraud and predict cash flow with high accuracy.

- Automation: Speeds up audits and tax filings.

- Data Analytics: Turns raw numbers into visual stories.

- Blockchain: Ensures secure and transparent transactions.

To stay relevant, you must master these digital tools. This is where specialized education makes a big difference.

BBA in Finance and Accounting by ICA Edu Skills and Shobhit University

If you want to lead in this new era, you need the right foundation. The BBA in Finance and Accounting offered by ICA Edu Skills in collaboration with Shobhit University is built for this purpose. This program is unique because it focuses on 90% practical training. You don't just read about tools; you master them. Students get hands-on experience with TallyPrime, SAP FICO, and Zoho Books. One of the biggest highlights is the one-year paid internship. This allows you to work at a CA firm or a corporate office while you study. By the time you graduate, you are not a "fresher." You are a professional with a year of experience and multiple certifications.

Conclusion

The future scope of accounting and finance is about being more than a "number cruncher." It is about becoming a tech-savvy leader. Whether you choose an online BBA or a hybrid model, the key is practical exposure. Companies today value skills over just a degree.

Frequently Asked Questions

1. Will AI replace accountants in the future?

No, AI will not replace accountants. Instead, it will automate repetitive tasks. This allows human professionals to focus on high-value roles like financial planning and strategic decision-making.

2. What are the most important skills for finance jobs in 2026?

The most valued skills include data analysis (using tools like Power BI), proficiency in ERP software like SAP, and a strong understanding of GST and taxation.

3. Is a BBA in Finance and Accounting better than a regular BBA?

Yes, if you want a specialized career. A regular BBA is general. A BBA in Finance and Accounting provides specific technical skills and certifications that make you job-ready for the financial sector immediately.