Tithi Ghosh

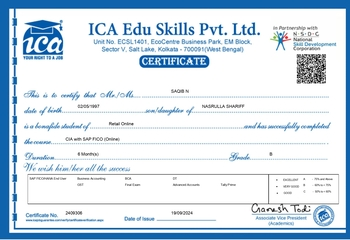

Course: Certified Industrial Accountant (CIA)

The Certified Industrial Accountant + SAP FICO program is a thoughtfully designed online accounting course that prepares learners for real-world applications. It begins by strengthening the foundation in accounting and taxation and gradually moves on to practical, industry-based examples and assignments. This course has empowered freshers to launch their professional careers, enabled working professionals to upgrade their skills for career advancement or new opportunities, and helped business owners gain a clearer understanding of their company’s financial health.

This course is perfect for:

After completing this program, you will be able to:

By the end of this course, you’ll become a certified professional capable of handling end-to-end accounting operations—making you a valuable resource for any organization. You’ll be well-prepared for roles such as:

Earn dual certifications with this course: an ICA+NSDC Certification for government-recognized credibility and a SAP FICO certification for in-demand global expertise. These credentials validate your skills and significantly boost your career prospects in accounting & taxation field.

Pre-Requisites for Joining this Course:

For more details - please connect with Career Coach at ICA Online

Our Testimonials

We take pride in the success of our students. Hear directly from them as they share their experiences, growth, and how our programs have helped shape their journey.

Faqs

You can email us with your registered email address along with your screenshot of the transaction. Once it is verified, the payment will be refunded.

You can try making the payment from a different card. Or you can follow the instructions of making payment here.

No, our course can be pursued from the comfort of your home with laptop and mobile.

You can start the course online by filling out the form with the required information and a batch will be assigned accordingly.

Your instruction will be delivered in a mix of English and Hindi

No, as it will be in an online mode, there are no fixed timings of the course.

You can check the course duration mentioned in the course that you are looking for. Ideally a course shall be completed by the time as mentioned in the duration.

They can ask for Hard copy also need to pay the courier charge.

Classes are held on specific days and times. Your instructor will lead the class and present the material. You can ask questions, participate in discussions, and collaborate with others, just like in a physical classroom. Instructors might use tools like screen sharing, digital whiteboards, and breakout rooms to make the learning experience more engaging.

You can directly call, whatsapp and email our support team. Please visit the contact us page to find the details.

Learning at ICA is fun because we've moved beyond traditional methods. Instead of the conventional way, you can learn through games, quizzes, short videos, notes, assessments, and competitions. You can also track your performance to see how you're doing.

You’ve seen the opportunity, now grab it! Get job-ready skills with ICA’s expert-led, practical training — anytime, anywhere..

The CIA course is excellent. Its hands-on approach with seven simulation software and 100% job assurance is a smart choice for anyone seeking a successful career in accounting..